All Magazine articles – Page 13

-

Magazine

MagazineThe role of private debt in sustainable infrastructure

Infrastructure represents $1.1 trillion of the annual investment required to address the UN Sustainable Development Goals (SDGs), according to the McKinsey Global Institute, making sustainable infrastructure one of the most important components in addressing the challenges and risks posed by climate change. Dillon Anderiesz from Macquarie Infrastructure Debt Investment Solutions (MIDIS) explores the role of private capital in infrastructure and how infrastructure debt is poised to be an important part of the solution.

-

Magazine

MagazineUK retail: shop till the market drops

After a disastrous year for UK retail, Mark Faithfull asks whether predictions of plunging shopping-centre valuations will finally materialise and reflect the upheaval in the sector

-

Magazine

MagazineImpact investing: Feeling the effects

Impact investing has quickly become a hot topic in institutional real estate circles. Maha Khan Phillips looks at the latest initiatives and what is causing their appeal

-

Magazine

MagazineEnergy transition: Transition management

Investing in new sources of power and the technology assisting ‘energy transition’ is a natural avenue for ESG investors. Christopher O’Dea reports

-

Magazine

MagazineESG: The foundation of responsible infrastructure investment

Today when we think about sustainable infrastructure investment, we mainly tend to associate it with renewable energy. And yet renewable energy is only one of the cornerstones of a responsible infrastructure debt investment portfolio. Investors seeking to diversify their infrastructure portfolio would do well to look beyond renewable energy assets by also considering the many other increasingly crucial environmental, social and governance topics to find best-in-class investment opportunities.

-

Magazine

MagazineTop 100 Real Estate Investment Managers 2018

The 100 largest property fund managers in the world manage €3trn of assets between them

-

Magazine

MagazineAllocation trends: No slowdown among real estate investors

A recent annual real estate survey shows rising asset allocations, improved investor sentiment and greater risk appetite. Stephanie Schwartz-Driver speaks to Doug Weill about the results

-

Magazine

Real estate funds: The UK's other big deadline

New capital gains tax rules for foreign investors take effect in April. Richard Lowe reports

-

Magazine

Infrastructure: Calling time on borrowed definitions

Infrastructure has adopted terms like ‘core’ and ‘value-add’ from other asset classes. But it needs better labelling, writes Sarah Tame

-

Magazine

MagazineUniSuper: Cash flows are king

Kent Robbins explains that when UniSuper invests in public and private markets, it is after the same thing – income streams. Florence Chong reports

-

Magazine

MagazineWater Risk: The real liquidity crisis

With cities like Cape Town facing ‘day zero’ crises, Monika Freyman explains why investors need to be alive to water risks

-

Magazine

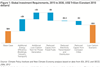

Private Debt: Investors drawn to debt for different reasons

Real estate and infrastructure debt is a fast-growing asset class among global investors, but for more than one reason, write Peter Hobbs, Niels Bodenheim and Sam Gervaise-Jones

-

Magazine

MagazineUK Healthcare: Market revival

Is the UK’s healthcare system going to be transformed by institutional capital over the next decade? Jennifer Bollen talks to the sector’s early movers

-

Magazine

Listed Infrastructure: IIT solutions

Does infrastructure need its equivalent of a REIT? Fraser Hughes and Ted Brooks make the case for the IIT

-

Magazine

MagazineMulti-Managers: The march of the indirects

A long-awaited mandate from Japan’s GPIF and a major corporate deal between LaSalle and Aviva show a maturing industry. But does LGPS pooling in the UK pose a threat to multi-managers?

-

Magazine

10 years after Lehman: Rate rises to test UK lending market

Leverage in the UK is lower than it was 10 years ago. But with price declines on the cards, investors should take extra care around high LTVs, write Nicole Lux and Sotiris Tsolacos

-

Magazine

Magazine10 years after Lehman: UK real estate funds

Property funds in the UK were hit dramatically by the financial crisis. John Forbes, PwC real estate leader at the time, looks back at the lessons learned

-

Magazine

Magazine10 years after Lehman: Banking in the shadows

Leverage is no longer the danger it was in 2008. But can investors and regulators be sure? As Richard Lowe reports, the European lending market is just as – if not more – in the dark

-

Magazine

10 years after Lehman: The lasting effects of sub-prime

Falling home ownership since the crisis has fuelled the multifamily boom, but why is the single-family market lagging? Christopher O’Dea and Richard Lowe report

-

Magazine

Magazine10 years after Lehman: German real estate funds

Not long after the global financial crisis, Germany’s open-ended property funds experienced their own existential threat. But the industry ultimately survived, writes Steffen Sebastian