Top 100 Infrastructure Investors 2025

Top 100 Infrastructure Investors 2025: Total assets rise 8% to $926bn

Full ranking of the largest pension, sovereign-wealth and insurance funds in the infrastructure

Access the Top 100 Infrastructure Investors Data. Support data-driven decision-making.

Download the complete 2025 survey dataset providing detailed information on 100 of the world’s largest infrastructure investors. Whether you are looking for data on competitors, clients or prospects this data will provide comprehensive insight into opportunities, challenges and market trends in the institutional real assets investment industry.

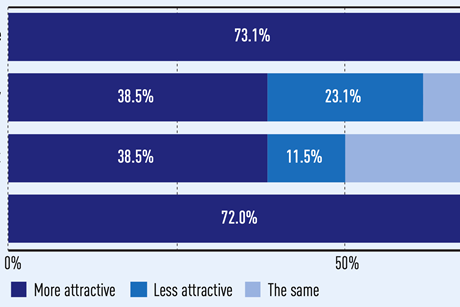

Infrastructure investor survey 2025: Investors near allocation targets

Capital flows likely to come from maintaining allocation levels

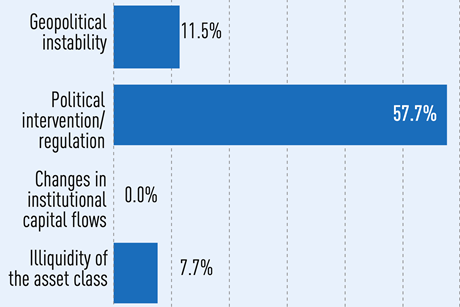

Infrastructure investor survey 2025: Key risks are politics and regulation

Political and regulatory uncertainty the key risks and challenges for investors

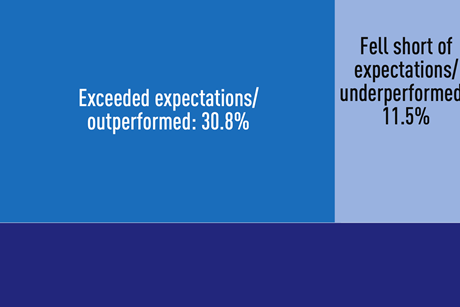

Infrastructure investor survey 2025: Asset class performs and hedges inflation

More than two thirds of investors say infrastructure has provided effective inflation protection

Infrastructure investor survey 2025: Investors target digital transition

Data centres and fibre networks lead the pack of favoured sectors

CPP Investments: Keeping pace with rapid fund growth

CPP Investments has been deploying billions into infrastructure, including data centres, as the pension fund is projected to hit C$1trn by 2031

AustralianSuper: Surfing the AI wave

The AI revolution is top of mind for AustralianSuper and underpins a strategic shift in the investment approach of Australia’s largest superannuation fund

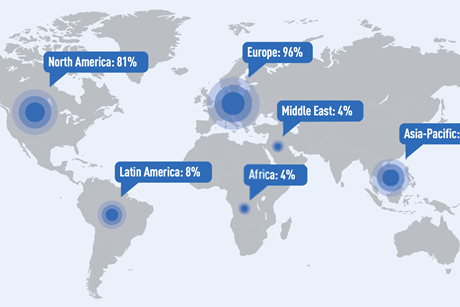

BCI: All eyes on ‘transaction-rich’ Europe for growth

Canadian pension fund BCI aims to substantially increase the share of European assets in its infrastructure portfolio, as it continues to look abroad for expansion

Industriens Pension: Co-investment as a pragmatic sweet spot

Industriens Pension has developed a taste for partnering with fund managers on infrastructure investments

RGreen invest, Renalfa Solarpro launch renewables and battery storage venture

Both sponsors are jointly committing €200m in equity to Renalfa Power Clusters

EQT acquires 42% stake in Yorkshire Water parent

EQT Active Core Infrastructure strategy has agreed to acquire the shareholding in Kelda Holdings

Top 100 Infrastructure Investors 2024: Survey

Institutional investors continue their journey in allocating to infrastructure after demonstrating stability during a period of volatility

Top 100 Infrastructure Investors 2023: Survey

Recent strong growth in allocations and investment appetite might be slowing, but investors are not yet applying the brakes to the asset class. Richard Lowe reports

Top 100 Infrastructure Investors 2022: Survey

After passing the COVID test, investors bet on infrastructure to help build immunity to inflation and reach net zero. Richard Lowe reports

Top 100 Infrastructure Investors 2021

IPE Real Assets’s ranking of the world’s largest infrastructure investors accounts for more than $545bn

Top 100 Infrastructure Investors 2020

The IPE Real Assets top 100 ranking of some of the world’s largest infrastructure investors has captured more than $467bn (€388bn) in infrastructure assets held by pension funds, sovereign-wealth funds, insurers and other institutional capital owners

Top 100 Infrastructure Investors 2019

The IPE Real Assets top 100 ranking of some of the world’s largest infrastructure investors has captured more than $415bn (€376bn) in infrastructure assets held by pension funds, sovereign wealth funds, insurers and other institutional capital owners