With the end of the transition period approaching, how can UK property fund managers continue to operate in the EEA and access European investors? Melville Rodrigues reports

After the Brexit transition period expires on 31 December 2020 (which is assumed from UK government statements), UK fund managers – including those operating unlisted real estate funds for professional investors in the European Economic Area (EEA) – will need to implement strategies to continue managing their EEA funds and marketing their UK and EEA funds to EEA professional investors.

It seems from the UK and EU post-Brexit transition period negotiations that the UK will no longer have access – known as passporting rights – to the EEA single market for financial services. This is relevant in the context of the Alternative Investment Fund Managers Directive (AIFMD) and the Markets in Financial Instruments Directive II (MiFID II).

Prior to the expiry of the Brexit transition period, full-scope Alternative Investment Fund Managers (AIFMs) under AIFMD are entitled to manage and market funds to professional investors in the EEA. In terms of operating a fund, the AIFM is responsible for portfolio and risk management, as well as an AIFMD depositary for cash-flow monitoring, asset safekeeping and custody. The FCA has ‘gold-plated’ aspects of MiFID II in the light of certain AIFM operations – for example, telephone recording, inducements and research, as well as distribution. The UK government is introducing UK regimes equivalent to the EU

AIFMD and MiFID II regimes from 1 January 2021.

These entitlements – based on the EU single-market principle – have resulted in UK and other EEA-based AIFMs building their businesses to operate and promote their funds to investors both in their home state and other EEA states, with relatively light additional access compliance by obtaining a ‘passport’.

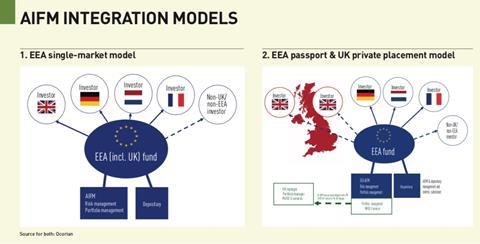

Typically, fund structures in the UK and elsewhere in the EEA targeting domestic and other EEA investors – as well as non-EEA investors via applicable financial promotion rules for those investors – are modelled as follows:

EEA single-market model

From 2021, UK managers – no longer entitled to the passport into EEA states – will need to consider alternative fund structuring solutions to continue marketing to EEA investors and managing EEA funds.

I outline solutions that could be considered (figure 1).

EEA AIFM outsource/delegate portfolio management

In July 2020, the European Securities and Markets Authority (ESMA), EU national regulators and the FCA confirmed that a February 2019 memorandum of understanding would apply, with the consequence that an EEA AIFM is allowed to outsource and delegate portfolio management back to a UK manager on behalf of the EEA AIFM.

However, this confirmation needs to be viewed in the light of an August 2020 letter from ESMA to the EU Commission with recommendations for future AIFMD II legislation.

The recommendations include:

● Clarification of the extent of delegation to ensure EEA AIFMs maintain sufficient EU substance;

● Addressing concerns with the third-party ‘host’ EEA AIFM model about conflicts of interest with the third-country managers and investor-protection issues.

I expect the Commission will give serious consideration to the ESMA recommendations, although there will be resistance to protect the global norm of delegation from the fund-management industry, as well as the UK, other third countries and EEA states . The eventual AIFMD II legislation – which will have to clear the EU trialogue EU legislative process (involving the EU Commission and approvals from the EU Council and Parliament) – might contain tighter delegation provisions, but hopefully will not hinder the efficiencies of delegation.

A UK fund manager looking to continue to benefit from EEA passporting rights, based on the July 2020 confirmation from ESMA, EU national regulators and FCA (albeit recognising the risk of restrictions under future AIFMD II), could consider two scenarios:

● The manager establishes and operates its own EEA AIFM – which also complies with any applicable MiFID II requirements. This is an investment choice that some managers will justify, given their current/prospective assets under management;

● The manager cannot justify establishing and operating its own EEA AIFM and enters into arrangements with a third-party ‘host’ EEA AIFM.

Under both scenarios, the EEA AIFM can delegate portfolio management back to the UK.

The ESMA letter recognises that “in light of the withdrawal of the UK from the EU, delegation of portfolio management functions to non-EU entities is likely going to further increase”.

Other fund structuring issues

UK real estate fund managers with pan-European operations should explore alternative fund structures involving an EEA AIFM, which take into account their own circumstances and could be influenced by the following key issues:

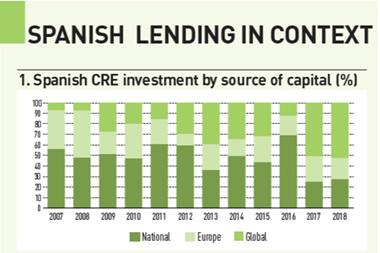

● The location and risk-return profile of the underlying real estate investments – for example, UK or mainland Europe. Certain UK and EEA investors may prefer to invest respectively in the UK or mainland Europe, thereby being more easily able to match investor liabilities and minimise risks associated with divergent market cycles experienced between the UK and mainland Europe and the sterling-euro currency exchange rate;

● The target investors – for example, tax-exempt or tax-paying, domestic or international (including non-EEA/non-UK investors and applicable treaty network), and any eligibility or financial promotion rules applicable to particular investors.

● Available fund structures, and in terms of target investors:

- Being familiar with the structures and relevant fund jurisdictions;

- Their appetite for leverage within the funds;

- Exit expectations, that is, closed-ended, open-ended or hybrid semi-closed/open-ended funds with limited redemption windows. How is the liquidity mismatch risk managed in meeting redemption requests?

● Additional tax and regulatory considerations, including:

- To attract pension funds and other tax-exempt institutional investors, funds are commonly tax transparent or exempt; and

- Management and control, as well as substance issues involved in cross-border operations, ensuring no ‘letter-box’ AIFM entities;

● The establishment and operational costs (including management fees), which can erode returns.

In the case of EEA fund managers wishing to retain market access to UK investors, managers may:

● Utilise the UK private-placement regime and financial promotion rules;

● Apply to the FCA under the temporary permissions regime. This entitles an EEA manager to operate in the UK after 2020 within the scope of their current permissions for a three-year period while seeking full UK authorisation.

UK managers marketing to EEA investors

For UK managers wishing to market UK real-estate investments via a fund to EEA professional investors, the 2021 outcome includes:

● Limited scope to rely on private-placement regimes in the EEA states (where the investors are based), and the EEA states will not provide temporary permissions regimes equivalent to those in the UK (see box above).

● No current prospect of the EU activating third-country AIFMD legislation, which could benefit UK managers – given that the UK will become a third country. In addition, AIFMD prohibits the marketing in the EEA of an EEA feeder to a non-EEA fund – a UK fund would become a non-EEA fund.

These managers might have to consider solutions with an EEA AIFM subject to complying with EU delegation legislation – for example (figure 2), managing an EEA fund, which would hold the UK real estate investments, marketed to:

● EEA investors via the EEA passport; and

● If appropriate, UK investors utilising the UK private-placement regime and financial promotion rules.

UK managers will need to consider various options with their fund administrators and other advisers to continue operating in the EEA and access European investors from 2021.

Melville Rodrigues is senior consultant, UK funds services at Ocorian