All articles by Stephanie Schwartz-Driver

-

Special Reports

Special ReportsInstitutional market for US single-family to multiply

It is still a niche for institutional investors, but single-family rental housing is following in the footsteps of the large multifamily market, Stephanie Schwartz-Driver reports

-

Special Reports

Special ReportsLife-sciences real estate: The US lab space race

The US real estate market cannot keep pace with the demand for specialist space from life-sciences tenants. Stephanie Schwartz-Driver reports

-

Special Reports

Special ReportsInterview: Ryan Williams, Cadre

Stephanie Schwartz-Driver speaks to Ryan Williams (pictured), who launched US proptech company Cadre when he was in his 20s

-

News

KIMC warns of mispricing of risk in US industrial real estate boom

CIO of real estate fund manager is

-

Magazine

MagazineImpact investing: US investors tackle housing affordability crisis

Real estate impact investing is picking up momentum in the US, where investors are recognising the ability to meet dual objectives. Stephanie Schwartz-Driver reports

-

Special Reports

Special ReportsRetail: A vulnerable sector in the US

Will disruption caused by the COVID-19 pandemic be the nail in the coffin for traditional bricks-and-mortar retail in the US? Stephanie Schwartz-Driver reports

-

Magazine

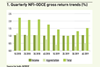

MagazineCore real estate US: ODCE funds grapple with disruption

In a changing landscape, ODCE fund performance has become more volatile. Managers have to innovate to stay relevant, write Stephanie Schwartz-Driver and Richard Lowe

-

Special Reports

Special ReportsHousing affordability: The spread of US rental controls

Rent control is gaining momentum in the US, with a number of local governments looking to step in to help make living more affordable. Stephanie Schwartz-Driver reports

-

Magazine

MagazineInvestor trends: US pension funds get their houses in order

US public pension funds are shoring up their real estate portfolios as the market cycle shows no sign of ending. Stephanie Schwartz-Driver and Richard Lowe report

-

Special Reports

Special ReportsListed infrastructure managers: Diverse opportunity set

Fund managers of listed infrastructure vary widely in their approach, but they all make the case for active strategies. Stephanie Schwartz-Driver reports

-

Magazine

MagazineAllocation trends: No slowdown among real estate investors

A recent annual real estate survey shows rising asset allocations, improved investor sentiment and greater risk appetite. Stephanie Schwartz-Driver speaks to Doug Weill about the results

-

News

Greystar raises $1.34bn for tenth multifamily property fund at first close

Greystar Equity Partners X plans to raise ts $2bn

-

Magazine

MagazineTop 100 Infrastructure Investors 2018

The assets of the 100 largest institutional infrastructure investors have increased by more than 20% over the past year. We speak to five of the biggest

-

Magazine

MagazineHugh O’Reilly: Ontario’s prudent risk allocator

Hugh O’Reilly took the top job at Canadian pension investment manager OPTrust three years ago. He talks about pursuing a member-driven investment strategy for real assets. Interview by Stephanie Schwarz-Driver

-

Analysis

Meeting of minds: Aon/Townsend and Stepstone/Courtland mergers

Not long after Aon acquired Townsend, StepStone revealed that it planned to acquire Courtland Partners. What do these mergers say about the real estate investment advisory industry?

-

News

North American RE investors show pragmatism over Brexit and Europe

HOOPP and Church Pension Fund among speakers at INREV seminar in New York

-

Magazine

Public access

Are investors missing a trick by focusing on private funds or and consortium deals? Christopher O’Dea and Stephanie Schwartz-Driver consider the listed alternative

-

Magazine

MagazineConsortiums: Safety in numbers?

Institutional investors are turning to consortiums to put money into the highly competitive global infrastructure market. Is it the right approach?

-

Magazine

MagazineCanadian investors: QuadReal, British Columbia’s new subsidiary

QuadReal is the latest standalone real estate company to be launched by a Canadian pension fund

-

News

AFIRE: Investors debate US outlook ahead of New York blizzard

Industrial sectors shines amid wider pessimism at winter conference in Manhattan