Institutional investors have backed Octopus Healthcare to more than double the initial £82m (€92.3m) raised a year ago for its new evergreen healthcare fund.

The specialist UK healthcare real estate investor said Octopus Healthcare Fund has raised an additional £105m after receiving capital from both new and existing institutional investors.

In November last year, Octopus raised an initial £82m for the fund, formally known as MedicX Healthfund I, following its conversion to a perpetual life vehicle.

The move to an evergreen structure comes in response to increasing investor appetite for healthcare real estate assets driven by stable, long-term RPI-linked income streams and favourable pricing relative to alternative sectors, Octopus said at the time.

The fund invests in modern, purpose-built, elderly care homes in the UK.

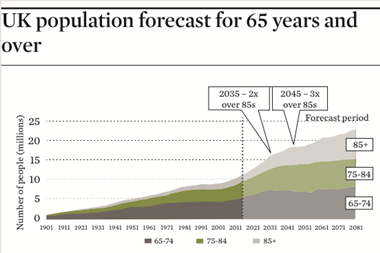

Ben Penaliggon, a director at Octopus Healthcare, said: “With the population of the over 85’s expected to grow by 64% to 2.6m by 2031, the UK is facing a severe shortage of suitable housing for the elderly. There is demand for modern, high-quality care homes in the UK, yet supply is limited.

“There is a huge opportunity for institutional investors to invest in this growing market and provide the capital needed to create suitable accommodation for the ageing population, while benefiting from the long-term, inflation-linked income that the sector offers,” Penaliggon said.

Hiti Singh, the head of institutional investment at Octopus, said: “Institutional investors are increasingly looking for alternative asset classes to expand or diversify their portfolios.

“Healthcare real estate offers a compelling combination of attractive fundamentals driven by an ageing population and long-term income, together with the social benefit of providing first class and modern accommodation for elderly people needing care”.