Alternatives

In-depth analysis and the latest news on retail estate alternatives: data centres, healthcare, hotels, leisure, life sciences, self-storage and student housing

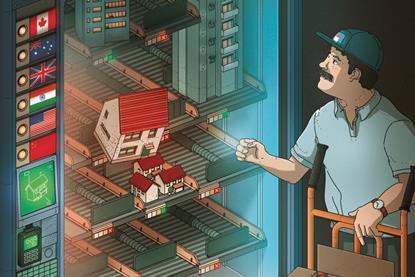

Reshoring is sparking fresh life into US life sciences real estate

Reshoring is creating new markets for US biomanufacturing. Virna Asara reports

Geopolitics and AI power new life science innovation hubs in Europe

The growing interplay between life sciences and technology is spawning new innovation districts amid a changing environment for the biopharma sector

Long overlooked, now catching the eye – Asia life science real estate

Asia-Pacific’s life sciences real estate market has historically been dominated by a few – mainly local – players, but that is starting to change

Paul Guest on uniting real estate with other alternatives at UBS UGA

The world’s largest real estate multi-manager, which was very active in 2025, is now part of a broader alternatives platform

CPP Investments, Equinix acquire atNorth for $4bn from Partners Group

Deal gives CPP Investments a 60% controlling stake

Focus Healthcare secures $80m for US senior housing fund

Ohio BWC and COPERS back Focus Senior Housing Fund III

Azora buys Barcelona student residence from LaSalle-Urbania partnership

Investment firm expands portfolio in a market characterised by strong demand and limited supply

India first for ESR as it invests in €84m Mumbai data centre

The investment marks the first move by the new economy real estate developer into the south Asian country

Azora buys Barcelona student residence from LaSalle-Urbania partnership

Investment firm expands portfolio in a market characterised by strong demand and limited supply

Student housing: Supplying a $1trn global higher education industry

Higher education is booming, and student housing has a crucial role to play amid fierce competition. Christopher Walker reports

CPP Investments, Equinix acquire atNorth for $4bn from Partners Group

Deal gives CPP Investments a 60% controlling stake

India first for ESR as it invests in €84m Mumbai data centre

The investment marks the first move by the new economy real estate developer into the south Asian country

Focus Healthcare secures $80m for US senior housing fund

Ohio BWC and COPERS back Focus Senior Housing Fund III

UK pension fund USS moves up the real estate risk curve

Head of property Alex Turner tells Lauren Mills how the UK pension fund plans to balance higher-risk investments with its fiduciary duty to members

Altus Property secures A$1.5bn Trump tower deal in Australia

The 91-storey Trump International Hotel & Tower Gold Coast to become Australia’s tallest building

Evolution Investment commits £1bn to London hotel projects

Newly launched global luxury hospitality fund buys two hotel assets in London’s Mayfair

Reshoring is sparking fresh life into US life sciences real estate

Reshoring is creating new markets for US biomanufacturing. Virna Asara reports

Geopolitics and AI power new life science innovation hubs in Europe

The growing interplay between life sciences and technology is spawning new innovation districts amid a changing environment for the biopharma sector

QuadReal finances UK self-storage and logistics projects in £86m deal

Plans to commit over £2.5bn over the next three to five years across Europe

Clarion targeting $1bn in seed capital for newly launched alternative property fund

San Diego City Employees’ Retirement System has approved a $35m commitment into the US-focused commingled fund

RoundShield exits German and Swiss campsites investment

Sale of Lodgyslife delivered a 32.5% gross internal rate of return

Greenridge buys One Tower Bridge retail and leisure property asset in London

Redevco sells asset in London’s Southbank for unspecified sum