AMP Capital and Enel Group’s energy services business have teamed up to develop electric transportation infrastructure in the Americas.

The $140bn (€122.5bn) global investment manager and Enel X have agreed to jointly invest in the development and leasing of vehicles for electric public transportation and associated infrastructure for the vehicles’ storage, charging, repair and operation.

AMP Capital holds an 80% controlling interest and Enel X holds a 20% interest in the joint venture which currently owns a fleet of 433 operating electric buses and associated charging infrastructure in Santiago de Chile.

The current assets were developed by Enel X over the past two years as part of the Transantiago 1, 2, and 3 projects. Enel X will also provide development and administrative services to the venture.

Simon Ellis, head of Americas at AMP Capital said this investment provides AMP Capital with an entry point into the e-mobility sector and represents the firm’s first significant investment in Latin America, a key target geography.

“This is a milestone for the global expansion of our infrastructure equity business and our growing presence in the Americas.”

Francesco Venturini, CEO of Enel X, said: “Urbanisation is one of the global trends that are changing the energy sector as megacities are increasingly requiring solutions for a clean, sustainable future, with electric mobility, both public and private, playing an essential role in this scenario.

“The partnership with AMP Capital reinforces our commitment to develop a sustainable, public mass transportation system, leveraging on our expertise in e-mobility and our strong presence in most of the megacities in the Americas.”

AMP Capital lifts stake in Australian water asset to 20.4%

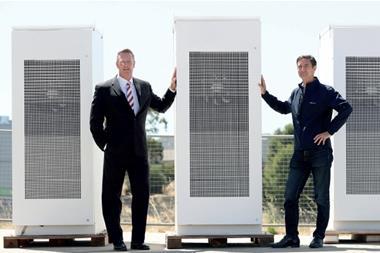

AMP Capital has acquired an additional stake in the A$3.5bn (€2.2bn) Victorian Desalination Project, making it the second-largest shareholder after industry super fund UniSuper.

The investment manager acquired the 3% stake from Victorian company Melro and Suez Water, a French company which was part of the consortium that built the plant in 2009. The plant is the largest water public-private partnership project in the Southern Hemisphere.

The price has not been disclosed, but IPE Real Assets understands the deal was transacted at between A$45m and A$50m.

The latest transaction lifts AMP Capital’s share of the Victorian Desalination Project to 20.4%. UniSuper is believed to hold almost 30%.

Other shareholders are South Korea’s Koomin Bank and Japan’s Itochu with Suez Water continung to hold a residual stake.

The AMP investment is held in AMP Capital’s Community Infrastructure Fund (CommIF).

Charles Savage, CommIF fund manager, told IPE Real Assets that the acquisition was the fifth in a series made by the fund over four years to increase its stake in the plant.

To read the digital edition of the latest IPE Real Assets magazine click here.