Latest reports – Page 566

-

News

NewsPeople moves: Bruen joins HIG; Toms named CBRE IM real estate partners MD

Argo Infrastructure appoints Gray head of energy transition and sustainability

-

News

NewsAPG and SiFi US fibre rollout venture secures $350m in debut debt financing

Future Fiber Networks secures seven-year financing from a club of banks

-

News

NewsIndiana PRS invests $100m in US industrial real estate via Ambrose fund

Ambrose Fund IV invests in speculative development projects and build-to-suit opportunities

-

News

NewsGlennmont enters storage market with 30MW Finnish battery project

Nuveen’s infrastructure manager teams up with Ilmatar and Alfen on 30MW battery storage project

-

News

NewsLa Française creates healthcare property refurbishment fund with Elsan

Manager acquires five clinics in €120m leaseback deal with Elsan as part of new partnership

-

News

NewsSlättö expands Swedish industrial portfolio with SEK455m purchase

Manager buys 10 assets for Slättö Value Add II fund

-

News

NewsMirvac, CEFC and Mitsubishi Estate create Australian build-to-rent partnership

Mirvac to hold 44% interest in A$1.8bn venture seeded with Mirvac’s operational BTR assets

-

News

NewsWaterton adds California asset to outbound hotels portfolio

US real estate investor buys Houndstooth Inn and its development site

-

PropertyEU Archive

PropertyEU ArchiveChristina Geib joins Quest Investment Partners as CFO

Christina Geib has joined the management team of German investment and project development company Quest Investment Partners as CFO.

-

PropertyEU Archive

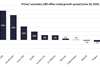

PropertyEU ArchivePrime European CBD office rents up 7.4% since Covid-19 - Savills

Average prime European CBD office rents have grown by 7.4% since the Covid-19 pandemic, above the secondary CBD average of 1.1%, according to research by Savills.

-

PropertyEU Archive

PropertyEU ArchiveSRV secures €24m residential building contract in Helsinki

Finnish listed construction company SRV has won a €23.8 mln contract to build a 101-unit residential building in Verkkosaari, Helsinki.

-

PropertyEU Archive

PropertyEU ArchiveCain renews €58m revolving credit facility with Tungsten Properties

Investment firm Cain has renewed a £50 mln (€58 mln) revolving credit facility with Tungsten Properties to fund a pipeline of logistics opportunities in the UK.

-

PropertyEU Archive

PropertyEU ArchiveLa Française REM snaps up five healthcare facilities in France for €120m

La Française Real Estate Managers (REM) has acquired five healthcare facilities in France as part of a sale & leaseback deal worth over €120 mln.

-

PropertyEU Archive

PropertyEU ArchiveKronos Homes to invest €100m in expansion of resi project in Portugal

Spanish real estate developer Kronos Homes is launching a new real estate project at the Belas Clube do Campo development near Lisbon.

-

PropertyEU Archive

PropertyEU ArchiveSlättö expands Swedish and Finnish logistics and industrial asset portfolio

Nordic alternative fund manager Slättö has acquired 10 logistics and industrial properties in prime locations in Sweden and Finland for SEK 455 mln (€38.7 mln).

-

PropertyEU Archive

PropertyEU ArchiveRICS standards board resigns en masse

All 10 members of the standards and regulation board at the Royal Institution of Chartered Surveyors (RICS) have tendered their resignation, without giving any reason.

-

PropertyEU Archive

PropertyEU ArchiveNewRiver REIT disposes of two UK retail parks for €73m

UK-listed real estate investment trust NewRiver REIT and PAF Lux SCA have divested two retail parks in the UK for £62.6 mln (€72.6 mln) to RI UK 1 Limited.

-

PropertyEU Archive

PropertyEU ArchiveVivawest unveils €70m new housing project in Dortmund

German housing company Vivawest is investing around €70 mln to build around 190 modern, partly publicly subsidised flats in Dortmund, Germany.

-

PropertyEU Archive

PropertyEU ArchiveCTP to develop logistics project in Bremen

European logistics developer and operator CTP has announced its first new construction project in Germany.

-

PropertyEU Archive

PropertyEU ArchiveLodge Quai funds complete €80m SLB real estate deal in Germany

Funds advised by UK-based real estate investment manager Lodge Quai (LQ) have acquired five corporate real estate assets in Germany.