Large real estate investors are turning to REITs to more quickly balance their portfolios. Florence Chong reports

Healthcare and telecommunications assets are powering ahead this year in the US real estate market – the world’s deepest market – but many institutional investors are missing the surge. In the year to 31 July, listed real estate investment trusts (REITs) in these two sectors returned 16.1% and 15.9%, respectively, outpacing all other property segments.

The gains highlight a widening performance gap between public and private real estate, and the growing case for a blended investment strategy. John Worth, executive vice-president of research and investor outreach at Nareit, the New York-based industry body for listed real estate, says: “REITs are clearly delivering real estate returns. Some of the largest real estate companies in the world are REITs, and they offer not just a portfolio of assets, but operating platforms that actively manage and grow those assets.”

Worth notes that 20, 15 or even 10 years ago, many investors dismissed REITs as small or mid-cap stocks rather than genuine real estate. “But today,” he adds, “very few would argue that REITs aren’t real estate.”

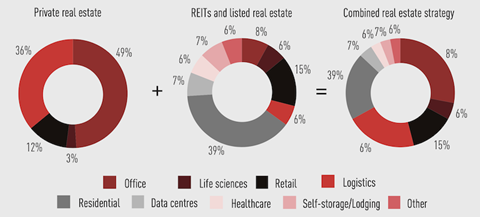

A paper by JP Morgan Asset Management’s Strategic Investment Advisory Group highlights the contrasting exposures of public and private real estate strategies. In the NCREIF Fund Index – Open-End Diversified Core Equity (ODCE), the largest sector (industrial) makes up 33% of the benchmark, and the four traditional core sectors account for over 90%. While the size of these sectors allows for geographic and property-level diversification, limited exposure to non-core sectors can restrict future growth.

“Today, very few would argue that REITs aren’t real estate”

John Worth

“In contrast,” the paper notes, “REITs offer more balanced exposure to the full spectrum of real estate, including extended sectors underrepresented in private funds.” In the Nareit index, retail – the largest sector – accounts for less than 15%, and the four traditional core sectors make up less than 50%.

According to Nareit, healthcare is today the largest property sector, with a market capitalisation of US$206bn (€177bn). Healthcare encompasses REITs and listed real estate companies that own and lease properties housing medical offices, skilled nursing and long-term care facilities, and senior housing. Retail is the next biggest with US$205bn, followed by residential with US$179bn and telecoms at US$169bn.

Worth cites Preqin data showing that over the past decade, the proportion of pension funds incorporating REITs into their real estate strategies has risen from around 40% to 50%. By asset weight, REIT allocations have grown from roughly 60% to 70% – a trend especially noticeable among the world’s top 25 real estate investors.

Nareit has recently been profiling case studies of this development, including Norges Bank Investment Management (NBIM), which manages the investments of Norway’s sovereign wealth fund. In 2019, its real estate portfolio was made up predominantly by private investments; today, its US$58bn real estate exposure is composed equally between listed and unlisted. Office properties previously made up nearly half of NBIM’s private holdings, but with REITs, the weighting drops to 28%.

NBIM currently allocates between 4% and 5% of its US$1.7trn in assets to real estate, with plans to increase this to 7%. “Norges’s approach is to manage the portfolio from the bottom up,” says Worth. “They don’t start with a fixed percentage allocation to REITs versus private real estate. Instead, they identify desired property sectors and geographies and then choose the most effective investment route – whether public or private. Interestingly, this bottom-up approach has resulted in an almost 50-50 public-private split.”

Norges Bank Investment Management real estate portfolio

Source: NBIM, EPRA. Data as of 31/12/23

Concentration risk also prompted an Australian superannuation fund to reassess its property strategy. Previously concentrated in domestic office, retail and industrial assets, the fund partnered

with PGIM to restructure its portfolio. Through the adoption of REITs, it gained diversification by geography and sector with exposure to multifamily housing, healthcare, specialty housing, self-storage and digital infrastructure across the US, Canada and Europe.

While some institutions have only recently adopted a blended strategy, Dutch investors have long pursued this integrated approach. Worth says Dutch pension fund asset managers – including APG, PGGM, Bouwinvest and MN – have consistently treated listed real estate as real estate. “These managers are focused on employing both listed and private strategies to their full advantage,” he says.

Rich Hill, senior managing director and global head of research and strategy at Principal Asset Management, agrees. “A portfolio that includes both listed and private real estate optimises outcomes. We’ve long advocated for a four-quadrant approach to real estate – public and private, equity and debt – as the most strategic way to access the asset class.”

He adds that global interest in blended strategies is growing, particularly among investors in the US, Europe and Australia. This is driven in part by strong recent performance. US-listed REITs are up 35% this year, while European REITs have gained over 25% in US dollar terms and more than 10% in euros.

“Some of the best-performing real estate sectors in the past two years – like data centres, senior housing and single-family rentals – didn’t even exist in institutional portfolios 10 or 20 years ago,” Hill says. “Private investors are realising they may be underexposed to these sectors and overexposed to traditional core assets.”

He also points to lessons learned during recent periods of illiquidity. “It’s been hard to redeem from private real estate funds, but with listed REITs investors have liquidity – they can trade every minute of every trading day.”

Uma Moriarity, senior investment strategist at CenterSquare, observes a growing convergence between public and private markets. “We’re seeing more synergies being recognised, and at CenterSquare, we’ve pursued this approach for 30 years. We believe it is the most strategic way to think about real estate.”

CenterSquare recently worked with an institutional client that had more than US$300bn in assets and was under-allocated to residential property. The firm recommended adding a “REIT sleeve” to the real estate allocation, quickly providing access to undervalued assets and addressing the gap in exposure.

This was not an isolated case. Moriarity says other clients are also integrating public and private real estate strategies and bringing the respective investment teams together. “These clients typically have large private real estate portfolios and want to create a more holistic allocation. We build what we call a ‘completion portfolio’ by directing capital toward sectors like data centres via REITs.”

“In the last five years, we’ve seen major valuation gaps between public and private markets. That creates a compelling opportunity”

Uma Moriarity

Moriarity adds that CenterSquare often uses this blended approach tactically to take advantage of market dislocations. “In the last five years, we’ve seen major valuation gaps between public and private markets. Core private fund valuations didn’t adjust quickly enough to rising interest rates, while REITs repriced almost immediately. That kind of arbitrage creates a compelling opportunity for tactical investment.”

She also emphasises the ease of scaling into under-represented sectors via listed markets: “If a client wants to expand into an asset class not covered by their private exposure, it’s much faster and more efficient to do it through listed REITs.”

Rich Hill estimates that having 10-30% of listed REITs in a portfolio helps reduce volatility and drawdown risk. “People often focus on returns and volatility, but drawdown risk – the peak-to-trough decline in portfolio value – is a key but under-appreciated factor. Because listed REITs act as leading indicators in both downturns and recoveries, they can offset declines in private markets and mitigate overall risk.”

An actively managed listed REIT strategy can also add alpha. According to Hill, the potential outperformance is typically 200-300bps annually. “If you have a 10% allocation to listed REITs, you get 10% of that 200-300bps. That can add up. But, of course, listed REITs can be more volatile in the short term.”

Worth says: “Ultimately, we see the integrated approach as the future of real estate portfolio construction. Combining public and private real estate brings out the best in both.”