All articles by Richard Lowe – Page 5

-

News

NewsStoneVest and Madison buy Berlin light industrial property as part of €150m JV

Asset acquired through a 15-year sale-and-leaseback with KWC Aquarotter

-

News

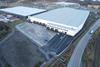

NewsClarion acquires asset in Venlo as it deploys €222m into Dutch logistics

Patrizia sells grade-A logistics property for €47.7m

-

News

NewsULI and LaSalle devise climate-risk action framework for real estate

Second in series of reports is designed to help real estate industry act on disclosure data

-

News

NewsBarings core fund sells Gothenburg logistics asset after two years

Clothing retailer buys 33,200sqm asset after Barings purchased it from NCC in March 2022

-

News

NewsBlue Owl buys Prima and hires GIC’s Hom to launch real estate debt platform

Blue Owl Capital to buy Prima Capital Advisors for $170m

-

News

NewsReal estate industry welcomes UK Transition Plan Taskforce sector guidance

Finalised guidance includes references to Better Buildings Partnership and industry recommendations

-

News

NewsHy24 leads €200m investment to expand Paris hydrogen taxi firm across Europe

Hydrogen infrastructure fund becomes majority shareholder in HysetCo

-

News

NewsIFM calls on investors to make infrastructure a ‘foundational asset class’

Fund manager argues for a standalone allocation, replicating – and potentially replacing – real estate

-

Analysis

AnalysisMIPIM 2024: Infrastructure gate-crashes real estate party

Major institutional investors converge on Cannes to discuss challenges facing asset class

-

News

NewsUK to legislate for reserved investor funds in boost for real estate managers

RIFs to be included in Spring 2024 Finance Bill and could help managers avoid going offshore

-

Opinion Pieces

Opinion PiecesIPE Real Assets March/April 2024: University of life (sciences)

Student housing and life sciences are separate real estate sectors but they form part of the same ecosystem of innovation

-

Analysis

AnalysisM&A: The race is on to get bigger in infrastructure fund management

Does the BlackRock-GIP merger mark the start of an infrastructure arms race? Christopher Walker and Richard Lowe report

-

News

NewsStafford Capital raises $635m for global timberland secondaries fund

Stafford International Timberland X is targeting $1bn by Q3, according to investor update report

-

News

NewsInvesco launches ‘direct’ global real estate fund for UK DC pensions

The vehicle will invest in other Invesco-managed funds and provide DC-friendly liquidity terms

-

Analysis

AnalysisIPE Real Assets January/February 2024: Natural capital sees growth as real estate wilts

The outlook for real estate markets in 2024 is mixed, at best. The hope is it won’t be as bad as last year, when the asset class experienced varying degrees of repricing across the globe. As Tom Leahy, head of EMEA real assets at MSCI Real Estate Research, quips, “2023 has not exactly been a vintage year for real estate”.

-

Special Reports

Special ReportsTop 50 natural capital investors

The 50 largest natural capital investors are dominated by North American institutions. Richard Lowe and Tjibbe Hoekstra report

-

Special Reports

Special ReportsGresham House: Accelerating ambitions under new owners

Tony Dalwood talks to Richard Lowe about the Searchlight takeover and the future of natural capital

-

News

NewsReal estate investors shift to higher-risk strategies, global survey finds

Investment Intentions Survey by ANREV, INREV and PREA show investors are closer to target allocations

-

News

NewsBlackRock to buy Global Infrastructure Partners to create $150bn giant

Merger would create infrastructure fund manager giant with more than $150bn in AUM

-

News

NewsReal estate associations update proposals for ESG metrics

Industry trade bodies submit update following FCA’s November announcement on SDR