The emergence of high inflation and net-zero objectives are encouraging institutional capital flows into infrastructure, but a cost-of-living crisis and growing risks of political and regulatory intervention mean investors face a difficult balancing act.

A survey by IPE Real Assets found that institutional investors are looking to infrastructure allocations to protect against inflation and to contribute to the energy transition, but political/regulatory intervention is the most concerning risk.

The findings were echoed by a panel of investors at the IPE Real Assets & Infrastructure Global Investor Conference & Awards 2023 in Amsterdam.

Stephen O’Neill, head of private markets at Nest, said the fast-growing UK pension fund had been attracted to infrastructure for its inflation protection and Nest’s own “aggressive net-zero target”, alongside its low volatility and the potential for pension-fund member engagement.

“Our investment objectives for our members is to deliver an inflation-beating return over their savings career. And other than index-linked gilts, there are little to no other assets which have quite the same inflation correlation,” he said.

“We’re trying to aggressively move towards halving the portfolio emissions by 2030, and there’s only so much you can do by tilting and weighting things in listed equity portfolios. But actually generating renewable energy – or converting diesel engines to hydrogen or electric engines in the transport sector – makes a huge and tangible difference to that decarbonisation.”

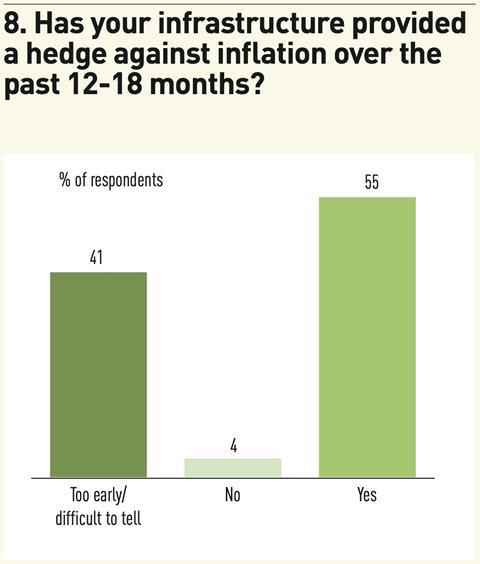

According to the survey by IPE Real Assets, 56% of institutional investors believe their infrastructure investments have provided a hedge, although 41% said it was too early to tell. Meanwhile, 70% said they were confident that infrastructure portfolios would provide a hedge going forward (26% were unsure).

“It’s a very important part of what the asset class offers,” said Simon Davy, head of real assets at the UK’s Local Pensions Partnership Investments (LPPI), who was also speaking on the panel. “We’re looking at long-dated inflation linked liabilities for our ultimate investors and pension clients.”

When asked to give reasons for investing in infrastructure, survey respondents repeated four key factors: stable cashflows, inflation protection, diversification and ESG/energy transition.

Other findings reinforced the importance of the latter. Waste/water, and solar and wind energy were the three most favoured sectors, while 74% of investors said they had an explicit objective or intention to contribute to the energy transition and net-zero agenda through their infrastructure investments.

NN Group first allocated to infrastructure several years ago for its diversification benefits, but Marieke van Kamp, head of private markets at the Dutch insurer, told the panel that “in time, it developed really into more and more a focus on climate solutions”. Van Kamp said the strategy is “much more focused now in in the renewable space and in the energy-transition space”.

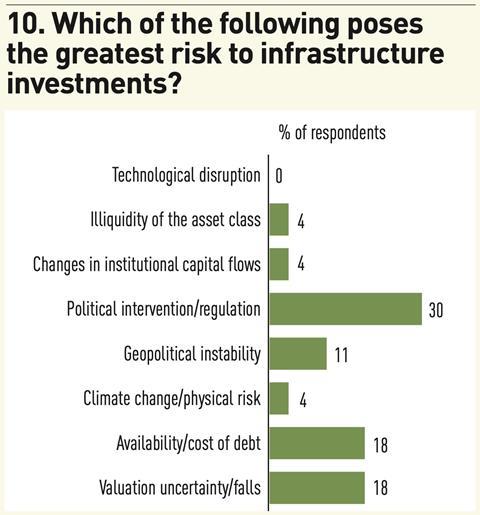

But while inflation protection and a desire to invest in clean energy are strong incentives, the survey showed that investors are concerned about the cost-of-living crisis fuelled by inflation and the potential for popular and political pressures and policy changes. Political intervention and regulation, collectively, was cited as the greatest risk facing infrastructure investments by more investors (30%) than any other, followed by valuation uncertainty and availability/cost of debt.

Jamie Clark, director of infrastructure debt for EMEA at MetLife Investment Management, which manages capital on behalf of US insurer MetLife and third-party investors, said private markets, and infrastructure debt in particular, have continued to “provide a really good diversification from the traditional public fixed-income markets” and recent crises have ”emphasised the stability of the asset class”.

But, he said, concerns about political and regulatory risk had ”been more prevalent in the past couple of years”.

He cited the Finnish electricity regulator, which carried out a “mid-period adjustment” to prices. “It wasn’t drastic against cashflows, but the fact that it was a mid-period change goes against the transparent nature, and so they were downgraded one notch and that then has an effect on the cost of debt they’re able to raise.”

Nest, a large defined-contribution fund that invests the retirement savings of UK employees that are ‘auto-enrolled’ into the pension scheme, has recently made a big push into renewable energy and has benefitted from recent rises in energy costs.

“We’ve got quite a lot of renewables and we’ve been able to benefit from that surge in the energy price,” O’Neill said. “It’s driving inflation and we’re making money from it.”

But the situation raises questions for an investor like Nest, which has to factor in the objectives of regulators and the wider interests of its own members. “The countervailing thing is whether or not regulators feel comfortable allowing all of that inflation to flow through to customers,” O’Neill said.

“Over 10 years, the UK regulators have actually been… quite investor friendly – I think it’s fair to say – about passing inflation through to customers, although for the last 10 years that was probably quite easy for them, because inflation was quite low.”

He added: “We also need to not lose sight of the fact that, as a pension scheme, the investors are [also] the customers… at a certain point it becomes a little bit perverse to think about whether or not, by ratcheting up the cost of these services and the cost of these commodities, you’re really improving the financial wellbeing of your scheme members. I think in high-inflationary environments, possibly you’re not.”

Davy said: “At the minute, the consumer has paid a lot, and I have a lot of sympathy with Stephen’s view. Probably top of my list of worries is political and regulatory risk… politicians perhaps want to distance themselves from taking the tough decisions and maybe try to pass that on at some point, given the cost-of-living crisis that we know affects a lot of people around the world.”

Impact investing and pension engagement

The panel was asked whether the focus on contributing to the energy transition meant they were becoming “impact investors”, and van Kamp said the weight of capital moving into renewable energy for net-zero purposes had meant “prices are becoming sharper and sharper, which then lead to discussions with the risk department on, is this a good balance” between returns and environmental impact?

O’Neill said the impact element of renewables and other forms of sustainable infrastructure was important for a DC pension scheme that is looking to increase member engagement.

“DC savers in the UK are terribly disengaged from their pensions but, if you can point up to a wind turbine… and say you own that, our research and our experience is that, especially with younger people and especially with renewable assets, they become more engaged and more interested in and feel more positively about their pension.”

Katherine Laurenson, head of alternatives distribution for EMEA at Legal & General Investment Management, said that the recent rise in bond yields, which has reduced the differential between fixed income and private infrastructure, has made the positive impact of investing in renewables all the more important. “It almost has to have impact to make sense in that context,” she said.

“You can say that categorically we are adding and doing positive things to impact a better future, and then it comes down to data points and proving [it] to investors.”

As the size of defined benefit pension funds in the UK decreases and DC pensions predominate as the main source of retirement capital, the issue of member engagement and infrastructure’s role in that will only become more important, she said.

“We were the largest manager of DB money in the UK and that’s going,” she said. “And so [with] the DC money, we’re really having to respond to the 35-year-old who’s just started on their career path and they do want to see their money have real impact.”

However, the DC pensions industry in the UK has broadly been set up to invest in assets and funds with daily liquidity. ”The operational and liquidity issues that we have to overcome are quite significant,” Laurenson said. “But the traditional private fund model doesn’t actually work very easily at all for the DC capital.”

She added: “But that doesn’t mean to say there isn’t a huge desire, and regulatory and policy push to get that capital into it for all the right reasons – impact but mostly the returns and growth that is required for that kind of younger cohort. So I think that’s the challenge we see, but hope to solve for the DC market. And it’s a huge opportunity if we can get it right.”

To read the latest edition of the latest IPE Real Assets magazine click here.