All articles by Richard Lowe – Page 24

-

Interviews

InterviewsInterview: Paul Kennedy, JP Morgan

He joins JP Morgan Asset Management at a point of unprecedented uncertainty, but the former ADIA strategist has learnt a thing or two about market cycles

-

News

NewsCore real estate to lose out to private equity in OCERS allocation overhaul

Pension fund to exit open-ended funds as it seeks to capitalise on dislocation in equity markets

-

News

NewsEDHECinfra captures COVID-19 impact on private infrastructure market

Recently launched indices show that unlisted infrastructure investments fell 6.37% in Q1

-

News

Capital Economics predicts 10% drop in UK commercial property values

Consultancy does not rule out a “full-blown crash” comparable to 2008 if effects are prolonged

-

News

US pension funds hit by denominator effect but still look for RE opportunities

Stock market declines lead to investors becoming over-allocated and some pausing new investments

-

News

UK property funds suspend as valuations hit with ‘material uncertainty’ [updated]

Several funds ‘gate’ and more expected to follow ahead of end-of-quarter valuations

-

Analysis

AnalysisCOVID-19: Immediate and long-term effects on RE could be substantial [corrected]

Slowdown in transactions, denominator effect and the acceleration of long-term structural shifts

-

News

Redevco to move beyond retail property and broaden investor base

Retail specialist to branch out into offices and logistics and to focus on joint ventures initially

-

News

NewsReal estate investment managers welcome government review of UK funds regime

Consultation could pave the way for more onshore close-ended funds in the future

-

News

NewsUK government urged to create new onshore fund structure for real assets

Closed-ended PIF would provide post-Brexit alternative to traditional offshore vehicles

-

Magazine

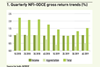

MagazineCore real estate US: ODCE funds grapple with disruption

In a changing landscape, ODCE fund performance has become more volatile. Managers have to innovate to stay relevant, write Stephanie Schwartz-Driver and Richard Lowe

-

Analysis

AnalysisEditorial: Real estate investors embrace the future

The rise of fintech and its cousin proptech has spawned an assortment of start-up companies determined to transform real estate investment by disrupting some of its archaic traditions. But not every new platform or digital solution designed to revolutionise the industry is relevant to institutional investors – nor are they likely to last.

-

News

M&G keeps UK property fund suspended

Fund managers working on increasing cash holdings in ‘more liquid market than last year’

-

News

Alaska Permanent debates direct real estate approach [updated]

Former board adviser Timothy Walsh had recommended stopping immediately

-

News

CBRE GIP recapitalises €3bn Cityhold partnership as TIAA sells 25% stake

Multi-manager joins TIAA, AP1 and AP2 in pan-European office joint venture

-

News

JP Morgan’s core fund enters joint venture with American Homes 4 Rent

Strategic Property Fund to increase exposure to single-family housing

-

News

Hines and QuadReal join forces to invest €1.25bn in European ‘living’ assets

Joint venture created to invest in BTR, student housing and serviced apartments

-

News

NewsPatrizia acquires real estate crowdfunding platform BrickVest

German fund manager takes over proptech firm that went into administration

-

News

Hines acquires Warsaw office for European value-add fund

Hines is acquiring a 34,000sqm office in Warsaw, on behalf of the Hines European Value Fund (HEVF 1). The Wola Center has been sold by Polish property company Develia, listed on the Warsaw Stock Exchange, for an undisclosed price. It is the eighth investment for HEVF 1, the core-plus/value-add fund, ...

-

News

NewsUnion Investment forward-funds speculative office project in Dublin

German fund manager acquires 2 Grand Parade from Hines and Peterson Group