Patron Capital and Electra Partners are jointly buying Grainger Retirement Solutions for £325m (€441m).

The joint venture between the institutional investor and private equity manager will take over the home reversion equity-release business of Grainger.

Retirement Solutions, which originates, consolidates and services home reversion equity-release plans, has around 20 staff.

Its current portfolio includes 3,500 properties.

Completion of the deal will see Patron and Electra each invest £45m, with equal board representation.

Patron Capital will be the operating partner.

Keith Breslauer, managing director at Patron Capital, said: “As property companies increasingly look to focus on pure development activity, we are taking advantage of the significant opportunity to acquire finance-related businesses and portfolios.”

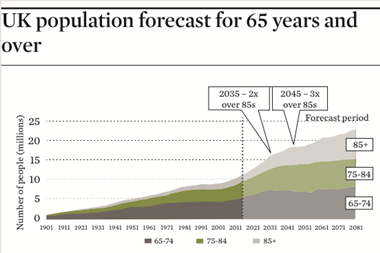

Breslauer said the deal, which follows acquisitions of shared equity mortgage portfolios from Galliford Try and Keepmoat earlier this year, provides the company with “a strong business that has an extensive portfolio and attractive exposure to the UK residential property market, particularly given the ageing population”.

Alex Fortescue, chief investment partner at Electra Partners, said the investment was a “strong fit” with the company’s long-term capital.