A proposed takeover of UK-based asset manager Schroders by US investment giant Nuveen could create the fifth largest real estate investment manager and 11th largest infrastructure fund manager, based on IPE Real Assets rankings.

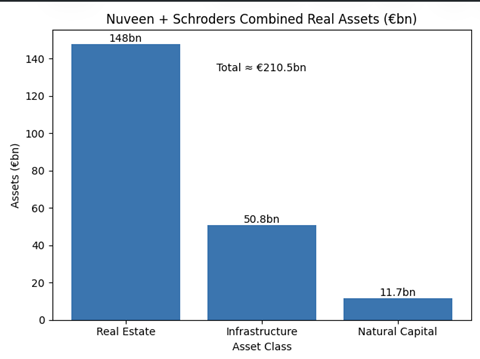

The tie-up between US$1.4trn (€1.18trn) Nuveen and US$1.1trn Schroders, would lead to a €148bn real estate fund manager and a €50.8bn infrastructure investment manager, based on last year’s figures.

When combined with Nuveen’s €11.7bn assets under management in natural capital, the combined company would manage more than €210bn in real assets.

Nuveen, which is owned by US insurance and retirement savings firm TIAA, announced on Thursday that an agreement had been reached over a board recommended cash acquisition for the entire issued and to-be-issued share capital of Schroders for approximately £9.9bn (€11.4bn).

The merger is the latest example of consolidation within the broader asset management industry. William Huffman, CEO of Nuveen, said the transaction was “about unlocking new growth opportunities for wealth and institutional investors around the world by giving our leading, differentiated public-to-private platform a broader global presence”.

But there will be implications for the real estate and infrastructure businesses and teams at both firms. It follows the ongoing merger of the investment businesses of French companies AXA and BNP, which has necessitated the integration of established real assets teams.

Over the next 12 months, Schroders is expected to continue to operate as a standalone business within the wider Nuveen group and will continue to be led by existing CEO Richard Oldfield, who will report to Huffman, and become a member of the Nuveen executive management team.

Schroders’ real estate and infrastructure business are led by Nick Montgomery and Minal Patel, respectively, while Jessica Bailey was recently appointed head of global infrastructure at Nuveen, and Chad W Phillips was made global head of real estate in March last year. Mike Sales is CEO of real assets at Nuveen.

The merger will also have implications for Schroders’ existing real estate and infrastructure funds and strategies, and future capital raising initiatives, with Nuveen in large part investing in real assets on behalf of its parent’s balance sheet capital, alongside third-party investors.

Nuveen, headquartered in New York, is much larger in US real estate, with more than three quarters of its real estate AUM in the Americas, and 19% in Europe and 5% in Asia-Pacific, according to IPE Research.

Schroders, meanwhile, is more concentrated in Europe – with the region representing 89% of its real estate AUM is in Europe – meaning it has a larger European real estate AUM in absolute terms at €25.8bn versus Nuveen’s €22.3bn.

Nuveen’s European real estate business is largely built on TIAA’s acquisition of the property investment arm of Henderson Global Investors more than 10 years ago, which became known temporarily as TH Real Estate.

Schroders has also made corporate acquisitions for its real estate business over the past decade, including Dutch firm Cairn Capital, Asia-Pacific fund manager Pamfleet, Germany’s Blue Asset Management and pan-European hotel specialist Algonquin.

Both Nuveen and Schroders have been building up their capabilities in infrastructure in recent years. In 2021, Schroders bought European renewables specialist Greencoat. Nuveen recently launched a global infrastructure platform, bringing together Nuveen Green Capital and its energy infrastructure credit and infrastructure equity teams.

To read the latest IPE Real Assets magazine click here.