The UK government’s charging infrastructure investment fund has teamed up with Liberty Global Ventures to roll out on-street residential electric vehicle charging points.

Liberty Global has partnered with the Charging Infrastructure Investment Fund’s (CIIF) manager Zouk Capital to create the 50:50 Liberty Charge joint venture.

Liberty Charge will focus on providing the under-the-pavement power and communications infrastructure necessary for electric vehicle charging in UK residential areas, the companies said in a joint statement.

The venture will provide charge point operators and local authorities with so-called ‘plug and play’ on-street charging facilities in large cities and towns where many residents don’t have access to off-street parking.

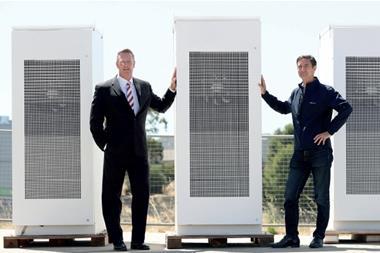

Liberty Charge was originally set up as a small incubation initiative within Liberty Global Ventures last year. Neil Isaacson, who has been leading Liberty Charge’s market development activities, has been appointed CEO of the venture.

Jason Simpson, vice president global energy and utilities for Liberty Global, said: “Zouk Capital is the perfect partner in this venture thanks to their sector expertise and focus on sustainability. We look forward to working with them to help drive electric vehicle adoption in the UK.”

Massimo Resta, a partner at Zouk Capital, said: “CIIF’s central objective is to scale open-access, public electric vehicle charging networks for the UK consumer and this is exactly what Liberty Charge will achieve for the thousands of car owners, who do not have access to off-street parking.”

CIIF was established by the UK Government in 2019 and backed by HM Treasury to help develop public charging infrastructure points for electric vehicles throughout the UK.

To read the digital edition of the latest IPE Real Assets magazine click here.