Latest reports – Page 1014

-

PropertyEU Archive

PropertyEU ArchiveListed property sector continues bull run - research

The European listed property sector ended the first half of 2021 on a positive note following further return gains in Q2, according to research by GPR.

-

PropertyEU Archive

PropertyEU ArchiveInvesco reaches final close for €750 mln ‘brown discount’ value-add fund

Invesco has reached its final target of €750 mln for EVAF II, its follow-on European value-add fund.

-

PropertyEU Archive

PropertyEU ArchiveFloberg Holding offloads Billingstad portfolio to syndicate

An investor syndicate arranged by Pareto Securities has acquired a portfolio of assets in Billingstad, Norway, from family-owned investment company Floberg Holding.

-

PropertyEU Archive

PropertyEU ArchiveKKR closes 2nd Europe fund on €1.9b

Global investment firm KKR announced on Tuesday that it has closed its second European real estate fund at $2.2 bn (€1.9 bn), amid strong interest from both new and existing investors.

-

PropertyEU Archive

PropertyEU ArchiveIcade completes €153m healthcare portfolio deal

French investment manager Icade has purchased a nursing home in Berlin for €45 mln, marking the last transaction in its nine-asset portfolio deal with Orpea.

-

PropertyEU Archive

PropertyEU ArchiveEdmond de Rothschild REIM picks up industrial asset in Amsterdam

Edmond de Rothschild REIM has purchased an industrial property in Amsterdam through a sale-and leaseback transaction with occupier Timtex Transport.

-

PropertyEU Archive

PropertyEU ArchiveKnight Frank appoints head of capital markets in Munich

Property adviser Knight Frank has appointed Sandra Schröder as head of its expanded capital markets team in Munich with effect from 1 July.

-

PropertyEU Archive

PropertyEU ArchiveAéma acquires Tour Keiko in Paris

Aéma REIM, part of Aéma Group, has acquired the Keiko Tower, a landmark office development in Paris, from AXA IM Alts.

-

PropertyEU Archive

PropertyEU ArchiveEXCLUSIVE: TPG Real Estate tipped to buy Heerema global HQ

Real estate investment platform TPG Real Estate (TREP) is understood to be in exclusive talks with 90 North Real Estate for the global headquarters of Heerema Marine Contractors, a marine contractor in the international offshore oil and gas industry.

-

News

Former Deutsche Bahn HQ sold to pension fund ahead of major revamp

Brutalist office complex in Frankfurt sold through unusual leasehold agreement devised by QUEST Funds

-

News

KKR to buy highway assets in India from GIP

KKR Asia Pacific Infrastructure Fund agrees to buy GIP’s interest in HC1 for an undisclosed sum

-

News

LeadCrest acquires €70m food supermarket portfolio in France

33,500sqm food supermarket portfolio is triple-net leased to Monoprix Exploitation and Distribution Casino France

-

News

Ascendas India Trust picks Airoli site for INR12bn data centre campus

6.6-acre greenfield site will be developed in phases into a fully-fitted data centre campus

-

News

Macquarie real estate fund makes follow-on office investment in Finland

Macquarie GLL European Property Fund invests €39m to develop two office buildings in Helsinki

-

News

DWS to raise €500m for new ESG-focused infrastructure debt fund

ESG Infrastructure Debt Fund to focus on ’sustainability-themed infrastructure sectors’ in Europe

-

News

IFM Investors consortium makes A$22bn offer for Sydney Airport

Sydney Aviation Alliance consortium includes IFM Global Infrastructure Fund, GIP and QSuper

-

News

AEW buys €80m logistics asset in Copenhagen for German pension fund [corrected]

Investment manager buys the Copenhagen Cargo Centre from Palm Capital

-

News

AustralianSuper consortium buys Australia’s largest intermodal freight facility

AustralianSuper, TCorp, Ivanhoé Cambridge and AXA IM Alts acquire Moorebank Logistics Park for A$1.67bn

-

PropertyEU Archive

PropertyEU ArchiveMore than a third of investors looking to buy more hotels in Europe - survey

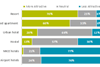

A survey of over 50 real estate investors by adviser Cushman & Wakefield has found that more than a third intend to buy more hotels across Europe, particularly resorts and serviced apartments, as the sector recovers from Covid-19.

-

PropertyEU Archive

PropertyEU ArchiveMacquarie forward funds Helsinki office development

Macquarie Asset Management is to invest around €39 mln in the development of two Gold LEED rated office buildings in Finland, on behalf of Macquarie GLL European Property Fund.