Just as the internet spawned e-commerce and the dramatic disruption of retail property, will remote working have a similar impact on offices? Himanshu Wani explores

When the Office for National Statistics (ONS) started publishing online retail sales in 2007, UK retail landlords were unaware that large chunks of their existing portfolios were already obsolete. After 2010, retailers began weeding out their portfolios, with store networks reducing over the proceeding decade and ‘showroom’ concepts emerging. The focus was on less but better space for national retailers.

This was reflected in the divergence between prime and secondary shopping centre rental growth. Prime shopping centre rents have more than tripled over the past two decades, while secondary shopping centre rents are 50% lower in nominal terms.

The office sector is going through its own structural change. It faces an obsolescence shock that could be larger than the one retail started to undergo in 2007 – a one-two combo of reduced tenant demand due to hybrid working styles and higher required ESG standards by both regulators and tenants.

We have undertaken new research to investigate whether parallels can be drawn with retail’s ‘internet moment’ in terms of how the office market is likely to perform in the coming years. Dividing each retail segment into ventiles allowed us to examine how both yields and rents changed between prime and secondary assets within the sector.

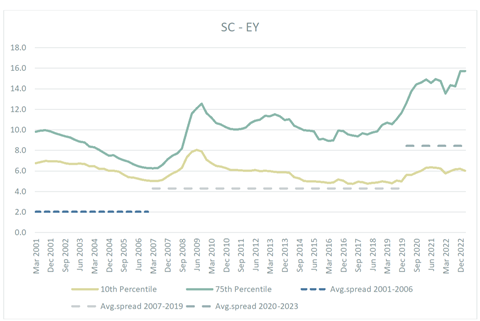

The 10th ventile was selected as a proxy for the prime part of the market, and 75th for average/secondary assets. The 75th percentile was chosen as it represents the mid-point of the bottom half and therefore most accurately reflects the performance of the average asset in the lower half of the sector.

The chart highlights the significant variation within retail re-rating, with the vast majority of outward yield movement confined to the non-prime part of the segment.

Equivalent yields in the 75th percentile – or on secondary assets – after global financial crisis (GFC) did not return to previous levels, re-rating fairly quickly to the demand shock from e-commerce, with the equivalent yield averaging 8% in 2001-2007 and 10% in 2008-2019. The demand shock from the pandemic caused a second more drastic re-rating, with the equivalent yield averaging 13.7% from 2019 to Q1 2023.

In contrast, the 10th percentile equivalent yield on prime assets post-GFC continued to decline until the pandemic-induced outward yield shift. Even the post-pandemic re-rating for prime assets is dwarfed by the re-rating in the secondary part of the segment (100bps vs 600bps).

Prior to 2007 and the start of the e-commerce age, the average spread between the 10th and 75th percentile was just under 200bps. In 2007-2019, the spread doubled to 442bps, and since the pandemic it has doubled again to 844bps.

Gleaning lessons from the retail sector and applying them to offices is fraught with risk, but we cannot discount the similar obsolescence shocks.

We’ve seen in retail that average and secondary quality assets re-rate fairly quickly, reflecting the added risk premium that comes from lower occupier demand. Prime parts of the sector were far less impacted by the emergence of e-commerce, as occupiers focused on less but better space. Rents on the other hand are far stickier and take much longer to reflect the new reality, as highlighted by average shopping rents only contracting by an average of 0.3% quarterly in the decade after the GFC.

There has already been a divergence in equivalent yields between prime and average/secondary quality offices, as well as continued occupier demand for best-in-class office space, reflected in the continued growth in prime rents. As seen in the retail sector, a demand shock takes much longer to feed into rental values. Average quality offices in the South East of England continue to see positive rental growth, averaging 0.3% since Q1 2020.

Even secondary quality office rent (75th percentile) has not fallen, remaining flat in the same time period. Of course, we cannot discount the increased incentives and landlord contributions that might be supporting the headline rent. But eventually, if the pattern is repeated, office stock of average and below quality will likely see rents fall significantly in the coming years.

With this in mind – and the shock to offices occurring recently with the pandemic catalysing hybrid working – we could be about to witness a structural change in the secondary office market where, to be successful in the future, assets will need to be repositioned.

For investors with the right skill set, this could offer attractive opportunities for well-located assets offering conversion or redevelopment projects to create assets that match demand from more buoyant sectors of the real estate market.