Despite unpredictable trade flows, Europe is showing signs of a structural increase in domestic timber demand, driven by its transition towards a low-carbon circular economy, writes Paul McMahon

The fraying of the transatlantic relationship is leading European investors to concentrate more on opportunities at home.

The forest products industry is an important part of the European economy today and a crucial pillar for the transition to a low-carbon economy in the future.

At the same time, this sector is not immune to trade uncertainty and geopolitical risks. As Europe looks to rely more on its own resources, there is an opportunity to better utilise the continent’s forests through investment and active management.

Starting from a position of strength

The forestry sector is a little-known source of strength in the European economy. Although the EU has just 5% of the world’s forests, it produces approximately 20% of the world’s roundwood each year.

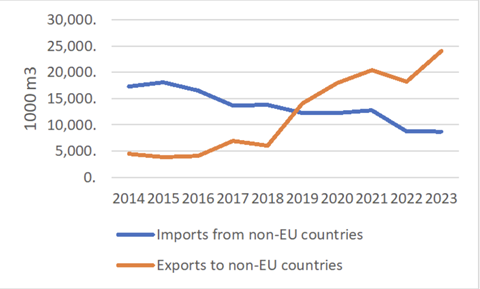

Over the past decade, the EU has gone from being a net importer of roundwood and fuelwood to a net exporter – with the EU’s net trade surplus reaching 15.4m sqm in 2023.

New geopolitical risks and trade uncertainty

The European wood products industry is not immune to geopolitical tensions. For example, roundwood prices spiked in the Baltic Sea region following the EU’s imposition of sanctions on Russia and Belarus – the historical suppliers to Scandinavia – in 2022.

EU wood exports to the US may be affected by new tariffs imposed by the White House, and the EU has threatened to include American forest products in its retaliatory tariffs. In 2023 the EU had a trade surplus with the US in wood, pulp and paper products valued at €3bn. High tariffs could disrupt these trade flows.

Simultaneously, the EU might take advantage of openings created by US trade wars with other countries. For example, the EU emerged as the second biggest exporter of softwood logs and lumber to China in 2024.

The shift to a low-carbon economy

Despite unpredictable trade flows, there are clear signs that Europe will experience a structural uplift in domestic demand for timber as part of a shift to a low-carbon, circular economy.

Currently, 40% of all European greenhouse gas emissions come from the construction sector. Wood is a sustainable building material that can substitute for carbon-intensive concrete, steel and aluminium. Similarly, paper, cardboard and bioplastics can displace plastics derived from fossil fuels; biochemicals can substitute for petrochemicals; and biomass is an increasingly important source of energy.

Research indicates that total demand for wood fibre in the EU will grow by 25% between now and 2050. This could lead to a 173m sqm ‘fibre gap’ by 2050.

Europe’s untapped forest resource

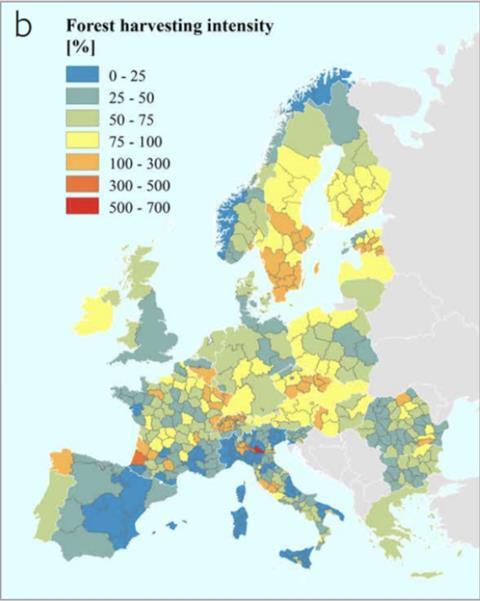

Thankfully, there is much scope to increase production. No more than 66% of the net annual increment of wood in EU forests was removed by the logging industry in 2022.

Why is there such a large gap between the potential for wood production and the amount of wood actually harvested? A major reason is the structure of forest ownership in Europe.

Across the EU, around 60% of forests are privately owned. The private forest estate is highly fragmented. There are an estimated 16 million private owners, of which two-thirds own plots of less than 3 hectares. Small forests owners are often unable to achieve the economies of scale required for efficient forest operations.

Applying active management to forests

As recognised by the EU Forest Strategy for 2030, active management must be implemented in neglected private forests to deliver a steady flow of wood for the European economy and to maximise forest health and carbon stocks.

This creates opportunities for institutional investors. Working with managers with boots on the ground, they can finance aggregation strategies that acquire private forests and introduce active management. One example is the SLM Silva Fund, which has invested in Irish forestry since 2018.

Europe is the last frontier for institutional investment in forestry within developed economies, as less than 1% of global institutional investment in forestry has gone to Europe so far.

However, aggregation will not be enough. The way we manage forests must also evolve to cope with societal pressure and climate change. Today, commercial forestry in Europe is dominated by single-species, rotational systems in which mature trees are clear-felled and replanted at regular intervals.

This industrial form of forestry is unpopular for good reason. Multi-functional or regenerative forestry, especially silvicultural systems such as continuous cover forestry, can unlock wood resources while also delivering carbon, biodiversity and amenity benefits.

The European forestry sector is already in a strong position. Yet Europe can achieve greater resource security by making more of its forestry resources, especially those that are privately owned. Institutional investors can play a role by financing aggregation strategies that support active, regenerative management.

To read the latest IPE Real Assets magazine click here.