Students are increasingly choosing study destinations based on a combination of quality education, affordability, safety and the ability to work both during and after their studies, writes Stefan Kolibar

There are currently 6.9m international students worldwide, and that number continues to grow steadily. The US, UK, Canada and Australia, often referred to as the “Big Four”, have long been the top choices for international students.

As these countries begin tightening policies around student inflows, more students are expected to consider alternative destinations. This shift is likely to boost demand for both education and student housing in these new markets, driving new student housing development, stronger occupancies, consistent rents, better yields and valuations.

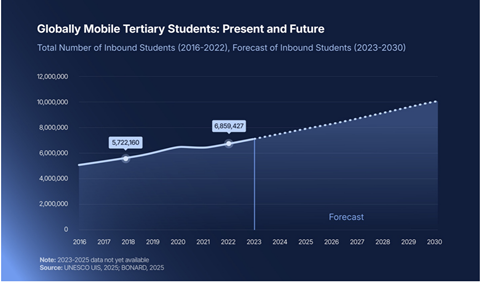

Global student mobility continues to grow despite disruptions

In 2022, 6.9m tertiary-level students opted for studying abroad. Despite two decades of global disruptions—from the financial crisis to the Covid-19 pandemic—international student mobility has grown steadily at a 5% CAGR.

This demand is structural, not cyclical, and is driven by rising numbers of high-net-worth and upper-middle-class families in source countries who seek access to quality education abroad, especially as domestic education systems struggle to keep pace. Many families no longer view international education as a luxury—it has become essential for future employability.

Institutions abroad often offer stronger reputations, higher academic quality, and better access to global career opportunities. In many cases, nowadays, success in the global labour market is difficult to achieve with a local degree alone. Students are increasingly prioritising destinations that offer a combination of quality education, affordability, safety, and work rights during and after graduation. The Big Four have traditionally delivered on these criteria—until now.

The big four are losing ground

For decades, the Big Four drew about one-third of all internationally mobile students— roughly 2.5m out of 7.5m. As of 2024, however, all four countries are tightening immigration and education policies, effectively capping international student numbers. Already in 2024, 285,000 students have chosen alternative destinations.

In 2025, it is estimated that at least 165,000 students will change their preferred destination away from the Big Four. Taking into account various policy shifts and data trends, it is reasonable to assume that the Big Four are now losing market share at a rate of at least 100,000 students annually.

One key lesson from the history of student mobility is that change happens fast. Prospective students are typically 18 years old only once, and the stakes—both financial and professional—are high. As such, both students and their families react quickly to policy changes that affect their opportunities.

Who are the winners?

Students’ preferences remain consistent and well-documented: Safety and predictability; a welcoming environment; English-taught programmes; quality and reputation of education; post-graduation employability; work rights during and after studies; tuition affordability; and reasonable accommodation options

The Big Four once ticked most of these boxes. Now, as these benefits diminish, students will seek them elsewhere, wherever comparable opportunities exist. Asian hubs such as Tokyo, Hong Kong, Singapore, and Malaysia are emerging as alternatives, but their capacity may not be sufficient to absorb the full magnitude of redirected demand.

Europe, on the other hand—particularly countries like Germany, France, Spain and Italy— appears well-positioned to fill this gap. These countries now offer many of the same advantages that once made Canada or Australia attractive, including relative affordability, safety and strong academic offerings, along with greater policy openness and housing potential.

Implications

This redistribution of international student demand will benefit host countries through increased spending, greater cultural exchange, and, over time, an influx of high-skilled talent. Some of these students will become skilled professionals, future residents, and taxpayers.

Rising student inflows are already supporting the student housing sector—boosting occupancy rates, rental income, development activity, and investor interest. As a result, valuations are expected to strengthen, accompanied by an influx of both new students and investors entering the market.

These trends present a timely opportunity to engage more deeply in student housing, currently ranked as the top alternative real estate asset class by investors, according to PwC/ULI Emerging Trends in Real Estate: Europe 2025.

To read the latest IPE Real Assets magazine click here.