Aquila Capital has made its first investment in the Scottish timber market.

The company said it bought 3,100 hectares of forest in Scotland for institutional investors.

The sitka spruce, lodgepole pine and fast-growing coniferous tree species will be managed by Tilhill Forestry, a subsidiary of UK operator BSW Timber, which has a £100m ($144.4m) turnover.

Aquila Capital said Scotland was an attractive market due to a long-term shortage of timber, importing 75% of its requirements.

Nils von Schmidt, fund manager for timber at Aquila Group, said: “This investment is an ideal addition to our existing timber portfolio.

“It provides institutional investors with access to professionally managed forests that have established timber production and continuous cash flows while fully complying with strict ethical and sustainability criteria.”

The forests acquired by Aquila Capital have, it said, internal and external transport links and easy access to market, while being mature and largely ready for harvesting and offering an immediate and continuous cash return.

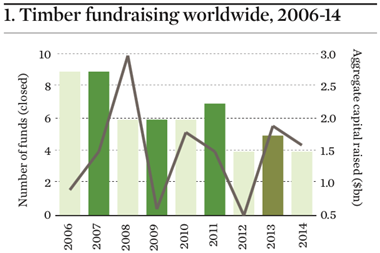

Investment in UK forestry reached a record high in 2014, according to a joint report by Tilhill and John Clegg & Co.

The UK Forest Market Report found that £151.15m worth of productive forests were traded in 2014.