Top 150 Real Estate Investment Managers 2025

Our annual Top 150 Real Estate Investment Managers Report offers vital market data of some of the world’s largest real estate fund managers. Access the report to benefit from:

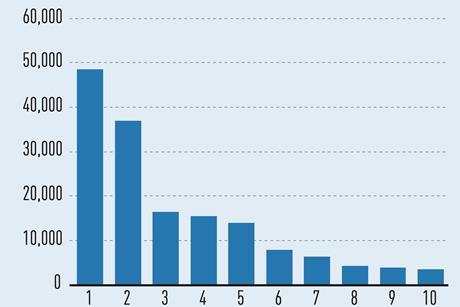

- Full top 150 ranking and top 10 breakdowns by sector, geography and strategy

- Analysis of industry trends, including M&A and consolidation

- An Excel spreadsheet containing AUM data on individual managers

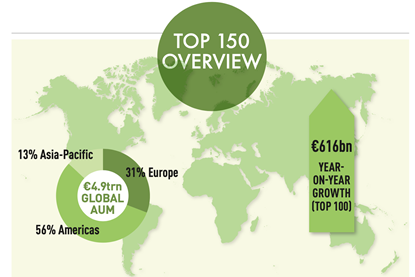

Top 150 Real Estate Investment Managers 2025: Lack of growth spurs M&A

Stagnation of AUM growth for the third year is helping to fuel a new wave of consolidation in the real estate investment management industry

Access the Top 150 Real Estate Investment Managers data. Support data-driven decision-making

Download the complete 2025 survey dataset providing detailed information on 150 of the world’s largest real estate fund managers. Whether you are looking for data on competitors, clients or prospects this data will provide comprehensive insight into opportunities, challenges and market trends in the institutional real assets investment industry.

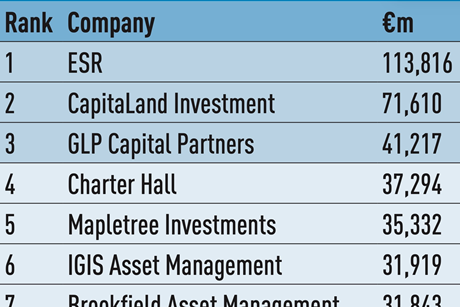

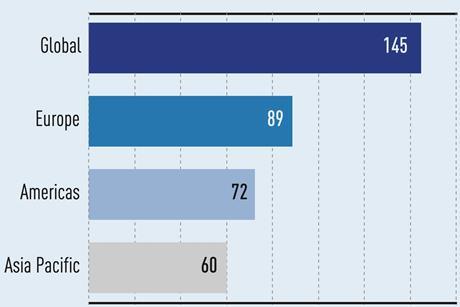

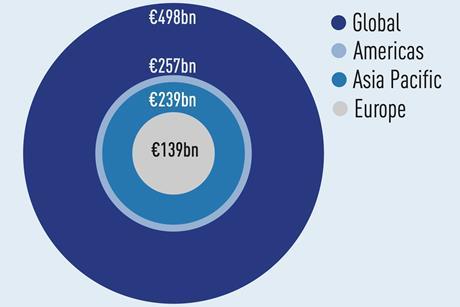

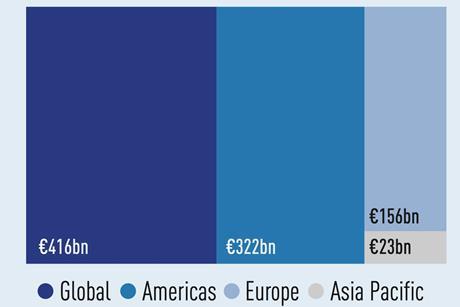

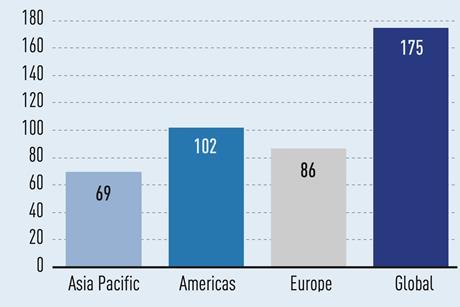

Top 10 real estate investment managers by region

Investors get very close to their targets

Top 10 real estate investment managers: Offices

PIMCO leads with €42.5bn in assets globally

Top 10 real estate investment managers: Retail

Nuveen leads with €21.8bn in assets globally

Top 10 real estate investment managers: Industrial

ESR leads with €107bn in assets globally

Top 10 real estate investment managers: Residential

MetLife leads with €87.7bn in assets globally

Top 10 real estate investment managers: Core

UBS AM leads with €142bn in assets globally

Top 10 real estate investment managers: Value-add

BGO leads with €32.4bn in assets globally

Top 10 real estate investment managers: Opportunistic

ESR leads with €43.6bn in assets globally

Top 10 real estate investment managers: Funds of funds and debt

UBS AM and MetLife lead with €48.6bn and €144bn, respectively

Prologis expands in Germany with acquisition of five logistics facilities

Assets will be integrated into the Prologis European Logistics Partners (PELP) fund

Patrizia launches €500m Berlin residential development plan

Development plan will be delivered though joint venture with local developer Cosimo

Previous Top 150 Real Estate Investment Managers reports

Top 150 Real Estate Investment Managers 2024: Turning a new page

Managers are positioning themselves for a recovery, but the next story of growth will be very different to the past. Richard Lowe reports

Top 150 Real Estate Investment Managers 2023

The AUM growth of the Top 150 has turned negative for the first time in 10 years. Maha Khan Phillips explores what is happening

Top 150 Real Estate Investment Managers 2022

The AUM of the Top 150 has risen 20%, but the €5.9trn industry must ride out a descent. Richard Lowe reports

Top 150 Real Estate Investment Managers 2021

Global overview and complete ranking

Top 150 REIM: Any room in the warehouse?

The Top 150 manage more than €4trn in assets, and the fastest growing sector is logistics. Richard Lowe reports

Top 100: One-stop shop

Investors’ drive to do more with fewer managers is accelerating consolidation as firms scramble to provide everything