All Real Assets articles in September/October 2025 (Magazine)

View all stories from this issue.

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2025: Total assets rise 8% to $926bn

Full ranking of the largest pension, sovereign-wealth and insurance funds in the infrastructure

-

Opinion Pieces

Opinion PiecesIPE Real Assets September/October 2025: The future of cities

Stormy conditions battered Rotterdam in mid-September, providing the perfect metaphor for this year’s IPE Real Assets Infrastructure & Natural Capital Global Conference & Awards 2025.

-

Special Reports

Special ReportsInfrastructure investor survey 2025: Asset class performs and hedges inflation

More than two thirds of investors say infrastructure has provided effective inflation protection

-

Special Reports

Special ReportsInfrastructure investor survey 2025: Investors target digital transition

Data centres and fibre networks lead the pack of favoured sectors

-

Special Reports

Special ReportsInfrastructure investor survey 2025: Investors near allocation targets

Capital flows likely to come from maintaining allocation levels

-

Special Reports

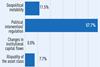

Special ReportsInfrastructure investor survey 2025: Key risks are politics and regulation

Political and regulatory uncertainty the key risks and challenges for investors

-

Special Reports

Special ReportsCity affordability: The drive to house London’s ‘city makers’

Initiatives are under way to provide more affordable homes for the UK capital’s middle-income earners, but progress remains challenging

-

Special Reports

Special ReportsCity affordability: Bridging the housing gap for europe’s ‘squeezed middle’

Governments and institutional investors are pulling together in their efforts to tackle the EU-wide affordable housing shortage. Lauren Mills reports

-

Special Reports

Special ReportsAustralianSuper: Surfing the AI wave

The AI revolution is top of mind for AustralianSuper and underpins a strategic shift in the investment approach of Australia’s largest superannuation fund

-

Special Reports

Special ReportsBCI: All eyes on ‘transaction-rich’ Europe for growth

Canadian pension fund BCI aims to substantially increase the share of European assets in its infrastructure portfolio, as it continues to look abroad for expansion

-

Interviews

InterviewsAndrea Palmer: CRREM’s first CEO on global expansion of net-zero initiative

CRREM is pushing hard across borders to become the global industry standard for real estate

-

Opinion Pieces

Opinion PiecesFinal word: Richard Croft asks, is debt the new equity?

There is a question as to how long the ‘smart money’ will remain invested in real estate debt funds before reverting to equity

-

Analysis

AnalysisBig investors turn to REITs to balance real estate portfolios

Large real estate investors are turning to REITs to more quickly balance their portfolios. Florence Chong reports

-

Analysis

AnalysisBehind Cohen & Steers and IDR's plan to combine REITs and ODCE funds

Two very different specialists have teamed up to bring public and private together. Florence Chong speaks to Jon Cheigh

-

Interviews

InterviewsNick Montgomery on continuing to build Schroders' real estate business

After one year in the job, Nick Montgomery has made significant progress, writes Lauren Mills

-

Special Reports

Special ReportsGreg Clark: Cities are like living organisms that need to be cared for

The acclaimed urbanist tells Christopher Walker why its important to understand each city’s DNA

-

Interviews

InterviewsPierre Cherki & Jenny Hammarlund on Ontario Teachers’ real estate reset

The duo talk to Christopher Walker about leading a “strategy refresh” from Toronto and London

-

Special Reports

Special ReportsThe future of cities: what are they for, where are they going?

Christopher Walker talks to leading thinkers in the built environment about the future role of the city

-

Special Reports

Special ReportsGo-to gateways: Oxford Economics' ranking of global cities

A new index by Oxford Economics has ranked global cities based on an array of quantifiable metrics. Isobel Lee reports

-

Special Reports

Special ReportsCity in focus: What could a mayoral shake-up mean for New York’s revival?

The Big Apple tops Oxford Economics’ global ranking, but housing affordability raises questions