Four months after completing its takeover of SEB Asset Management, Savills Investment Management is poised to launch a billion-dollar Asia core-plus fund.

The new vehicle, to be known as Savills IM Asia Fund 3, is expected to be launched in the second half of the year.

It will be the successor to Savills Asia Fund II, a €200m closed-ended fund formerly known as SEB Asia Fund II which was launched before Savills IM’s takeover of SEB.

Justin O’Connor, CEO of Savills IM, told IPE Real Estate: “It will be a pan-Asian fund investing in income producing assets.”

The fund will focus on investing in Australia, Japan, Hong Kong, Singapore and China – markets that can offer stable cash flows and reasonably strong fundamentals over the long term.

O’Connor said the fund needed to have a ‘core-plus’ strategy to reflect the fact that so many markets in Asia are considered emerging markets.

“If you want to be rewarded for the increased risk in some of these markets, it has to be a core-plus approach,” he says.

Equity will be sourced principally from Europe, but O’Connor said Savills IM has recently begun raising capital in the US.

Some money will also come from Asia, depending on how much the fund invests in particular countries.

“One of the biggest issues is that you often find that people – for example, Singaporeans – are not so keen if your investment is in Singapore,” O’Connor said.

“It needs to be a reasonably diversified fund to attract the interests of Asian investors, particularly if you are presenting a core-plus fund.”

Markets in this region could change quite significantly by the time the fund is ready for investment and throughout its investment period, he adds.

“It is a good time to be acquiring assets,” he said, “as long as you are prepared to take some risks to ride out the tough times.”

Although price adjustment is now underway, O’Connor said this should not detract from the basic fundamentals of countries in the region.

“Take Singapore as an example,” he said. ”It may be on a rocky road today, but fundamentally it will be good in three or four years’ time.”

Quality assets in Australia, however, remain fully priced, O’Connor said. Australia has received large amounts of international capital recently and this has pushed prices to new levels.

However, he adds, recent economic data shows a weakening of the Australian economy and this could seep through into the property sector.

“It will be interesting to see what the pricing will be in Australia in a year’s time,” he told IPE Real Estate.

Depreciation of the Australian dollar is not helpful to foreign investors which have to hedge against currency fluctuations. Hedging is very expensive in Australia.

“If you are prepared to take the risk of not being hedged, you could be caught out in terms of capital gains because of a weakened Australian dollar,” O’Connor. said

“This is one negative about the Australian market.”

Savills IM, which previously traded as Cordea Savills, bought out the real estate funds management platform of the Swedish bank SEB in a deal finalised last September.

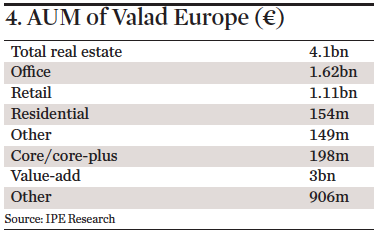

O’Connor said the acquisition doubled the firm’s assets under management in Europe and Asia. Today, the company manages about $20bn in assets – $2.5bn in Asia and the balance ($17bn) in Europe.

O’Connor told IPE Real Estate: “SEB gave us an investment platform and track record through which to set up a pan-Asia fund platform out of Singapore.

“We see this as part of the evolution of our industry, which is about consolidation. We see investors wanting to invest with larger managers who have a track record and a platform.”

O’Connor said Savills IM has been gradually building up its presence in Asia through acquisitions.

In 2013, it acquired Merchant Capital, set up by two ex-Merrill Lynch bankers – Tom Silecchia and Tadaai Kurozumi – in 2005. To beef up its Asian operations, Savills IM has a recruited Craig Pearce, formerly of Morgan Stanley, to head up its asset management business in Asia.

Others in its Asian team include Michael Flynn, who heads up its operations in Australia and Southeast Asia, and Jin Guo, head of Greater China. Guo was recruited from ICBC International Investment Management, which set up a number of real estate funds for Chinese state-owned enterprises.