GRESB has analysed its real estate dataset to determine the true state of play of decarbonisation efforts. Victor Fonseca explains

While net-zero goals are critical for society to address climate change and global warming, there is no consensus on a global, standardised approach to account for net-zero emissions. Even though the concept might seem simple, real estate companies use different approaches when talking about net zero in their buildings and corporate strategies. For example, the accounting method for emissions calculation (location versus market-based emissions) and acceptability of emissions removal (for example, carbon offsets) can vary depending on the definition that market participants are using.

This variation in scopes and accounting methods can have significant implications for climate goals in the long run, but it should not be allowed to stifle decarbonisation of the real estate sector. Every year, real assets funds and assets report their ESG data to GRESB, the global ESG benchmark for real estate and infrastructure investments. The data is then compiled into GRESB benchmark reports and actively used by more than 170 institutional and financial investors.

Leveraging the 2022 GRESB real estate assessment dataset, composed of about 140,000 operational real estate assets, GRESB conducted a timely analysis to gain a better understanding of the progress of the real estate industry with regard to net zero. To determine the state of play on net-zero performance in the real estate industry, GRESB assessed the real estate dataset against three relatively rough definitions of net zero for real estate.

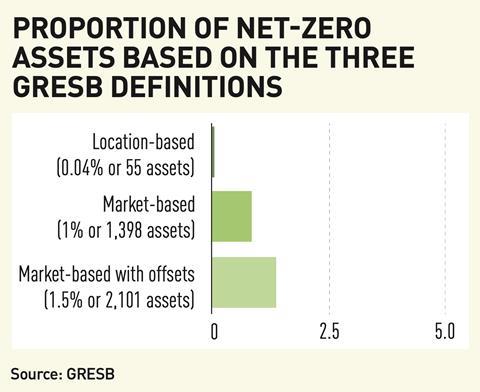

The first net-zero definition assessed refers to assets fully powered by onsite renewable energy generation, whereby only 55 assets qualify. This represents 0.04% of the total number of assets that reported to GRESB in 2022.

This definition uses the location-based approach, which ascribes an average emissions factor to electricity imported to buildings from the grid based on the average ‘dirtiness’ or ‘greenness’ of energy generation feeding into that grid. Notably, it does not acknowledge the purchase of offsite renewable energy. This reflects a rather aggressive definition for many reasons. Certain property types do not typically have enough surface area available for the installation of enough onsite renewable energy generation (for example, solar panels), resulting in limited capacity of decreasing their scope 2 emissions without first implementing aspirational energy-efficiency measures. In addition, solar resources are not uniformly available across the planet, nor does the sun shine at night, and technologies for storing renewable energy produced onsite are not always financially viable.

The second net-zero definition refers to assets fully powered by onsite or offsite renewable energy. When applying this definition, the number of assets that qualify increases to 1,398, or around 1% of the GRESB asset database in 2022. It is important to note that this group encompasses the first group.

This definition uses the market-based approach, which allows for the use of contractual instruments to claim the use of low or no-carbon energy and lower its corresponding emissions profile. This approach is less aggressive than the location-based approach because real estate companies can supply their assets’ energy demand with power-purchase agreements or renewable-energy certificates, where energy is generated offsite and consequently not limited to the assets’ surface area availability.

Lastly, GRESB analysed a third definition (albeit not a common one) that allows for the use of carbon offsets for ‘residual emissions’ that could not be mitigated by one’s own operations. Under such a definition, the number of qualified assets increases slightly to 2,101, constituting 1.5% of the 2022 GRESB dataset.

One might note that, while navigating through three different relatively rough definitions of net zero, the number of qualified assets does not drastically change and, ultimately, the overall number of assets that are currently net zero is very low. Nevertheless, these results are not fully reflective of the long-term decarbonisation strategies that these assets may be employing. The results shine a light on the state of real estate portfolios, providing a snapshot of where the assets are today in net-zero terms, but do not account for the fact that many assets are still mapping their path to net zero. The results also do not reflect initiatives that may be under way but may not yield results until later.

Different net-zero approaches typically involve complex and long-term strategies, such as transitioning to onsite or offsite renewable-energy sources and implementing energy-efficient technologies. As a result, the impact of these approaches may not be immediately noticeable in the short term when it comes to crossing the net-zero/non-net-zero threshold, but rather play a role in reducing greenhouse gas (GHG) emissions and mitigating climate change over the course of the journey.

In fact, GRESB data shows that the location-based GHG intensities of 33,811 real estate assets are below the 1.5°C decarbonisation pathways developed by the Carbon Risk Real Estate Monitor (CRREM) in 2021. This means that roughly 25% of all real estate assets reporting to GRESB are emitting in line with CRREM-aligned targets for achieving net-zero emissions by 2050. This indicates that these assets are on track to achieve net zero under the most aggressive definition assessed here.

This finding emphasises how critical it is for real estate companies to devise a strategic decarbonisation roadmap for their portfolio with actions that are effective as of now, because the urgency of the climate crisis demands immediate action. Some net-zero definitions are more aggressive than others because they may require more rapid or deeper reductions in GHG emissions, but they all converge on the principle of maximising energy efficiency while transitioning to renewable-energy sources. Ultimately, the stringency of a net-zero definition depends on the specific details of what is being targeted and how it is being measured.

At GRESB, the development of a global, standardised definition of net zero that takes into account different market realities of the real estate industry is a crucial step towards achieving the ambitious goal of reducing GHG emissions to zero. Establishing consensus on what constitutes net zero aims to provide the long-term direction of travel for real estate companies, while incentivising the implementation of opportune measures at the right time. Even though the path towards a global standard may be complex, the result will be a shared understanding of the goals and methods required to create a net-zero world, in real climate terms.

Victor Fonseca is real estate associate at GRESB