The Urban Land Institute (ULI) and LaSalle Investment Management have devised a framework to help the real estate industry act on climate-risk disclosure data.

The report, Physical Climate Risks and Underwriting Practices in Assets and Portfolios, is the second in a series by ULI and LaSalle. The first report outlined how to source and interpret reliable climate risk data and the second is intended to provide a market overview, adaptable framework and recommendations based on emerging best practices for incorporating physical climate risk in the underwriting process.

“Physical climate risk data collection and disclosure is the first step the real estate industry can take to further invest in and build resilient infrastructure,” said Lindsay Brugger, head of urban resilience at ULI.

“Data drives action and doing nothing incurs deeper costs – from higher insurance premiums to asset repair or replacement. Focusing on the underwriting process, the framework offers investment managers a methodology for developing risk-adjusted returns so deals can be adapted in alignment with a firm’s fund or portfolio objectives.”

Julie Manning, global head of climate and carbon at LaSalle, said: “This report helps provide guidance that investment managers can follow to factor the climate risk data they have available to them and improve outcomes at the asset and portfolio level.

“We want to lead the conversation across the industry and collaborating with ULI is a great conduit to amplify the discussion that will ultimately benefit investors of all kinds with more resilient real estate portfolios.”

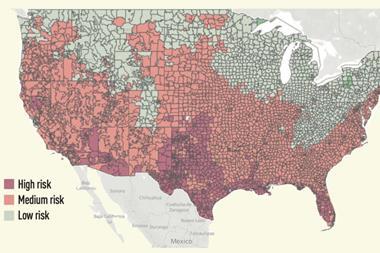

Simon Chinn, vice president, research and advisory services at ULI Europe, said: “In Europe, there is certainly increasing recognition of both physical and especially transitional risks that climate change poses to the built environment. However, as this report suggests, concerns regarding physical risk arising from weather and climate related extremes may be perceived as a lower priority in Europe, compared to the US and Asia, which have to date experienced a greater frequency and intensity of hazard events, particularly hurricanes and wildfires.

“However, perceptions of physical risk on the continent are beginning to change, particularly as the latest data from the European Environment Agency revealed that 2021 and 2022 combined yielded €111.7bn of damage across the EU, a 40-year high. Proactive, data-driven strategies to take action and mitigate risk in future will be essential, and this new framework provides an invaluable roadmap to navigate this complex area.”

The framework is broken down into three steps for decision-making, based on individual asset risks, local market risks and ongoing risk mitigation efforts: evaluation of the level of exposure to physical climate risk and financial implications; identification of hazard mitigation strategies and estimatation of associated costs; and the determining of risk-adjusted returns and whether they meet investors’ objectives.

To read the latest IPE Real Assets magazine click here.