Global investor confidence in real estate has surged to its highest since 2019, according to the 2026 Investment Intentions Survey by INREV, ANREV and PREA.

The survey carried out by the three regional real estate associations revealed that 38% of investors globally expect allocations to increase over the next two years, compared with 28% anticipating a decrease, signalling “growing expectations of market recovery, following a prolonged period of correction across global real estate markets”.

Overall, the results suggest investors believe markets have moved past the worst of the downturn and are positioning for an early recovery phase.

According to the report, average global real estate allocations currently sit at 12.4%, slightly below the 12.5% target level. While this gap indicates potential for additional capital deployment as confidence stabilises, investor activity remains subject to clear regional differences.

European investors’ allocations, which were on target last year, are now 20bps higher than their average target of 13.9%. Asia Pacific and North American investors remain underallocated by 200bps and 40bps respectively, relative to their average respective targets of 10.1% and 10.8%.

In terms of access routes, real estate debt funds have returned as the most popular route into European real estate in 2026, after one year in second place, reflecting demand for income and downside protection. Joint ventures, club deals and non-listed real estate funds also feature prominently, as investors seek flexible, risk-aware exposure supported by local market expertise. Interest in non-listed real estate funds also increased compared with last year, from 8% to 17% on a net basis.

The report said Europe continues to dominate global destination preferences for real estate investment, accounting for seven of the top ten preferred global markets. The region continues to draw strong international interest, with Asian Pacific investors in particular seeking exposure to European strategies as part of their recovery positioning (31%), while notably reducing outbound investments to the US (16%).

Within Europe, the UK and Germany retain their positions as the top two preferred destinations, underpinned by their scale, liquidity and transparency. Spain remains firmly established in third place, supported by strong demand in the living sector.

Sustainability continues to play a central role in real estate investment decision-making, with almost 60% of investors now having set a net zero target, driven by long-term risk management considerations and regulatory alignment.

However, most investors continue to favour later timelines, with over two-thirds targeting net zero post-2040, reflecting a pragmatic approach to implementation.

Over half of respondents in Asia Pacific and Europe plan to increase allocations to impact-driven investments, while North American investors show more cautious sentiment, with only 30% targeting such investments, the report added.

Iryna Pylypchuk, INREV’s director of research and market information, said: “After several years of market correction and uncertainty, the 2026 Investment Intentions Survey suggests investors are clearly positioning for a recovery, but the approach feels different.

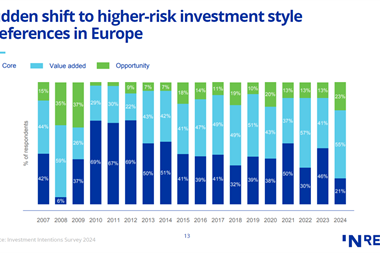

“Investors are tackling the next phase of the cycle with greater discipline, deploying capital selectively across both core and high risk strategies to drive returns. Active management of existing portfolio ranks as the second most important issue amongst investors globally as alpha generation is expected to play a pivotal role in driving outperformance.

“Europe continues to play a central role on a global stage, attracting sustained interest from both domestic and international investors, while long-term themes such as sustainability and asset resilience are increasingly shaping how and where capital is deployed.”

To read the latest IPE Real Assets magazine click here.