Over 90% of investors will be targeting residential real estate this year according to Inrev’s 2024 Investment Intentions Survey which is based on responses from 90 investors representing a combined AUM of €830 bn.

Residential tops investors’ preferred asset classes for the first time in the history of the survey. The 90% result compares to 60% in 2023 and is close to the 87% received by industrial/logistics in 2024 (which also reported a staggering increase from 46% in 2023).

Other sector favourites in 2024 are student accommodation with 45% (up from 15% in 2023) and healthcare with 35% (up from 19% a year earlier). For these sectors, given the sheer size of the market, it may be challenging for investors to deploy that big amount of capital, according to Iryna Pylypchuk, INREV’s director of Research and Market Information.

‘The same goes for healthcare which was picked by 35% of investors this year,’ she noted. Retail on the other hand is Europe’s least favoured sector with only 16% of investors looking to deploy capital, down from 31% in 2023. ‘There might be an opportunity there since nobody is looking for retail assets,’ added Pylypchuk.

With ongoing macroeconomic uncertainty impacting the global real estate market in 2023, investor appetite for the real estate asset class in general has slowed, with the gap between average current allocations and target allocations across Europe, Asia Pacific and North America, decreasing for the third year running.

On a weighted AUM basis, the current average allocation to real estate globally is 10.6%, just slightly above the average target allocation of 10.4%. The slight overallocation is largely due to European investors who have an average allocation of 10.5%, which is 67 basis points (bps) above the average target, up from 30 bps showed in 2023.

European investors are the most bearish on expected allocations, with a substantial 43% expecting a decrease in allocations and only 16% expecting an increase. Investors from Asia Pacific are the most bullish with diverse cross-regional investment plans, 41% of Asia Pacific investors expect allocations to increase, while 0% expect a decrease.

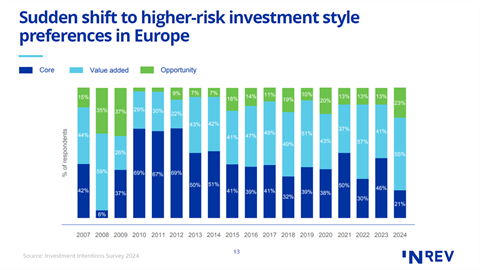

Investors shift to higher-risk strategies

The shift towards core strategies reported last year has seen a sudden reversal. In fact, over three quarters (78%) of investors looking to deploy capital in Europe in 2024 are seeking higher-risk strategies, with the majority (55%) preferring value added strategies. In contrast, only 21% of investors chose core as a preferred strategy – this being the lowest share recorded since the global financial crisis in 2008. Opportunistic strategies are sought by 23% of investors in 2024, up from 13% a year earlier.

This echoes the search for value added strategies in the aftermath of the global financial crisis of 2008, where higher-risk strategies yielded substantial returns. While the underlying causes of the current downturn are entirely different, early equity-rich movers may be identifying investment opportunities, anticipating a window to tap into a higher return potential.

Despite showing increasing preference towards non-core strategies – rising from 43% in 2023 to 64% this year – European investors remain the most risk-averse.

After six years in the wilderness, the UK has regained its position as Europe’s preferred investment destination, rising from 50% in 2023 to 84% in 2024. It is followed by Germany and France in second and third place, with 81% and 65%, respectively. Current market uncertainties and shift towards higher-risk strategies go hand in hand with greater preference for scale and liquidity.

After five consecutive quarters of negative capital growth, the UK All Property pricing correction since the end of Q2 2022 stands at -22.77%1, in comparison to just -13.49% for Germany, and -14.19% for France. Investors are likely attracted to the substantial markdowns and opportunities for further discount in the UK.

Southern Italy is also showing up strongly in investors’ buy list, with 64% and 52% respectively for Spain and Italy. Pylypchuk: ‘The return of interest for Spain and Italy has to do with the tailwinds favouring the residential sector.’ She continued: ‘We also see Sweden coming back in a stronger position, with the market showing a lot of repricing and some distressed opportunities as well as a depreciation of the local currency.’

Across all three regions of Europe, Northern America and Asia Pacific, the two most important factors affecting 2024 investment decisions were interest rates and inflation. In Europe and North America, the third most common response was the denominator effect, indicating that real estate capital deployment over the next year may depend on what happens across more volatile equity and fixed income markets.

Investors from all three regions reported a stronger focus on diversity, equity, and inclusion (DEI) programmes in 2024. At 73%, DEI saw a significant jump in importance for European investors, up from 57% in 2023.

Interestingly, while 59% of investors globally have set a net zero target, almost 60% of these have identified a time horizon of post-2040 – a decade on from what many initially expected to be a goal of 2030. This is likely the result of current market conditions and the costs associated with meeting net zero targets.

Pylypchuk said: ‘We are entering a window of potential mispricing and repositioning opportunities be it through a bottom-up asset selection, by exploring market bifurcation or through private equity play as cash deprived players struggle to service their debt.”