A fund that tracks the NCREIF Open-end Diversified Core Equity (ODCE) index is offering wealth managers access to a $337bn (€329bn) market that has mainly been the preserve of institutional investors.

The IDR Core Property Index Fund, which has raised $4.2bn from institutional investors according to sources – including, recently, the California State Teachers’ Retirement System – has been opened to wealth management platforms.

The move will diversify the capital base of the index fund, which currently includes large institutions with significant investments in the fund – including the Teacher Retirement System (TRS) of Texas, which committed up to $990m in 2018.

Jared Morris, investment manager for real assets for Texas TRS, said: “What IDR is doing is a major innovation for private equity real estate and will bring the same portfolio benefits to both large institutions and qualified retail investors.”

The fund managed by IDR Investment Management invests in all funds that make up the NCREIF ODCE index, which is capitalised by more than 4,000 global investors with around 3,300 properties across 35 US markets.

Gary Zdolshek, CEO of IDR, said, “We are excited to welcome accredited investors to join our institutional investor base in what we believe should be the third leg of a compelling investment strategy alongside equities and bonds.”

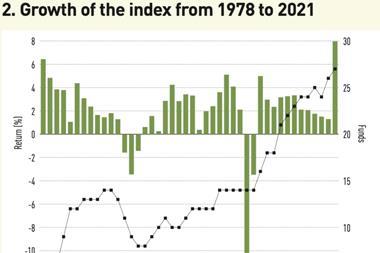

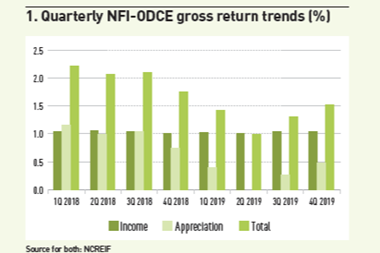

Garrett Zdolshek, portfolio manager for IDR, said: “Diversified private real estate investment provides many potential benefits and historically has provided a hedge against inflation, stable income and a low correlation to stocks and bonds.

“Indexing also reduces single-property and manager-selection risk, while providing potentially attractive returns over a full market cycle.”

IDR now has separate investment vehicles for institutional and retail investors, with minimum requirements of $10m and $25,000, respectively.

The fund raised more than $650m from institutional investors during the first half of 2022, according to sources.

To read the latest edition of the latest IPE Real Assets magazine click here.