Glennmont Partners has increased its initial €600m fundraising target for its third clean energy fund by more than 41%.

According to sources, Glennmont Clean Energy Fund III is now expected to raise €850m.

Glennmont, which raised €195m at first close in January of last year, declined a request for comment. Predecessor funds I and II raised €437m and €500m, respectively.

US pension fund Missouri Local Government Employees Retirement System (LAGERS) said it had approved a €65m commitment.

Brian Collett, CIO for the $7.73bn pension fund, said: “We think that Glennmont is a strong manager and this commitment will give us some diversification within our infrastructure portfolio.

“We do have other managers who do some investing in Europe, but this is our first Europe-only infrastructure commitment.”

Missouri LAGERS expects the pan-European fund to produce net internal rate of returns in the low teens.

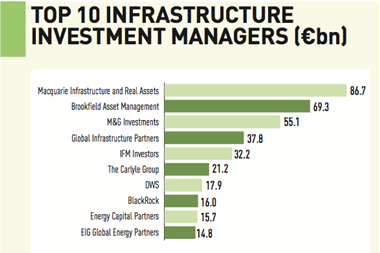

Missouri LAGERS has also made a $100m commitment to Global Infrastructure Partners (GIP) Fund IV and a $75m investment in PGIM Real Estate’s Senior Housing Partnership (SHP) VI.

GIP’s latest fund is expected to be its largest yet as it seeks to raise $20bn.

As previously reported, PGIM is at an early stage for the core-plus US Fund VI and its target is unknown. Its predecessor fund raised $629m at close in May 2015.

“Our thinking on this commitment is that senior housing is not covered by any of our other real estate managers and we have been pleased with the investment performance of our commitment into SHP VI with the same manager,” said Collett.