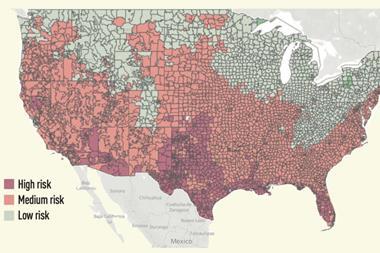

Climate change is adversely impacting real estate transactions and investors are expected to closely examine the financial implications of climate risk on their assets, according to a survey by real asset sustainability consultancy Evora.

Evora’s annual Insights Into Real estate Investment Sustainability Survey, which captured responses from investors with $3.3trn (€3.1trn) assets globally, found that 46% of the 102 real estate investors have witnessed the impact of extreme weather on their investments.

Meanwhile, climate risks mean that some are experiencing a fall in property values, income and occupancy rates, as well as rising insurance costs.

Sonny Masero, chief strategy officer at Evora Global, said real estate investors are waking up to the fact that climate change is happening and is affecting their assets.

“Last summer we had extreme heat across Europe. Floods and storms are becoming very common in many parts of the world. To suggest this isn’t going to harm investments is folly. Climate risk is a real and present danger and investors are going to have to make changes as a result.

“When assessing value, investors need to consider future changes that could undermine historical market comparables data. There are climate risk factors which could accelerate how climate change affects value.”

Masero called on investors to start planning for the future.

“Our world is changing fast, it’s essential that investors keep up. To ensure their fiduciary duty is being carried out, their investments need to be made in a forward-thinking way, informed by climate science and observed data,” said Masero.

The survey found that environmental, social and governance (ESG) data is now being used by practically all investors. However, just 11% are confident in the quality of the data being supplied.

“There’s also a greater demand for ESG-related data and analysis of the threat posed to assets from climate change, all of which is welcome,” Masero said. “However, the fact that data isn’t well trusted is definitely a cause for concern and something the industry must work on.

“Nonetheless, I do believe we are seeing a shift in the minds of investors, where climate risks are being seen as much more important than they have been previously.

“The world’s biggest asset owners now want to understand how exposed they are to climate risks. Those with the most to lose appear to be the most concerned and actively starting to price -in climate risks,” Masero said.

To read the latest edition of the latest IPE Real Assets magazine click here.