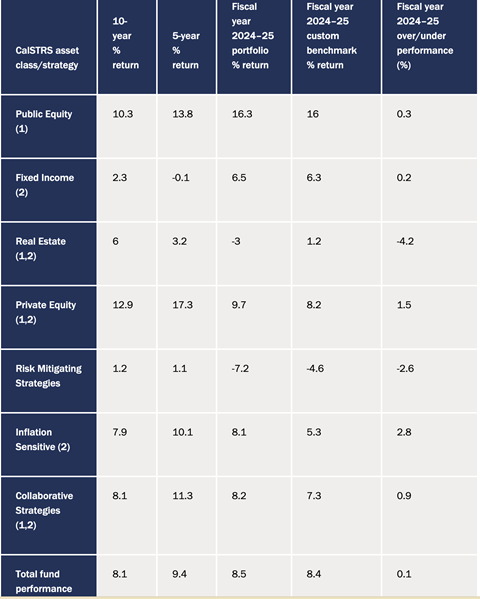

California State Teachers Retirement System’s (CalSTRS) real estate portfolio has underperformed over the 12 months ending 30 June 2025, generating a negative return of -3%.

The US public pension fund said its $47bn (€40.1bn) real estate portfolio performed below its benchmark, the NFI-ODCE Value-Weighted Index, which recorded a 1.2% net return over the same period.

CalSTRS declined to comment, but according to sources familiar with the portfolio, the underperformance could have been caused by traditional office holdings and life-science assets.

During the pension fund’s previous fiscal year, the real estate portfolio outperformed its benchmark, despite generating a negative return of -9.8%.

Over the last five years, CalSTRS’s real estate portfolio generated a 3.2% return, and 6% over the last 10 years. The pension fund did not provide equivalent figures for its benchmark.

As of 30 June this year, the real estate portfolio made up 12.78% of the pension fund’s $367.7bn total assets, below its 15% target allocation.

The IPE Real Assets Top 150 Real Estate Investors 2025 ranks CalSTRS as the 10th largest real estate investor.

For the 2025 fiscal year, CalSTRS’s overall investments generated an 8.5% net return, slightly outperforming its benchmark’s 8.4%.

Scott Chan, CIO at CalSTRS, said: “While the 8.5% return over the past year is a solid result, our true commitment lies in creating consistent, decades-long growth for our members’ pensions.

“Our highly diversified portfolio has yielded a track record of returns above our 7.0% investment assumption and demonstrates our effective approach to investing in an increasingly complex market.”

To read the latest IPE Real Assets magazine click here.