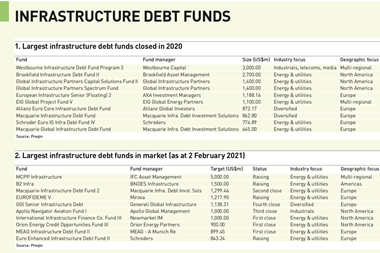

Brookfield Asset Management has raised over $6bn (€5.7bn) for its third global infrastructure debt fund – more than double the $2.7bn raised for its predecessor.

The fund manager said the capital raised for Brookfield Infrastructure Debt Fund (BID) III, which includes over $400m in discretionary co-investment capital, makes BID III the world’s largest private infrastructure debt fund.

Brookfield has committed $600m to the fund, which will focus on renewable energy globally, providing mezzanine debt for core assets.

BID III’s backers include public and private pension plans, sovereign wealth funds, financial institutions, endowments, foundations and family offices.

As previously reported, Maine Public Employees Retirement System and the New Mexico State Investment Council committed $250m and $150m, respectively, to the fund.

In August, during a second-quarter earnings announcement, Brookfield said it expected to raise $5bn for BID III, which at the time had secured $4.3bn from investors and was expecting a final close later this year.

Brookfield said BID III had already deployed over 50% of its commitments, investing across core infrastructure sectors, including renewable power and data infrastructure.

Ian Simes, managing partner and co-head of Brookfield’s infrastructure debt and structured solutions businesses, said: “With access to the Brookfield ecosystem of real-time data and global expertise, we are able to identify high-quality businesses, operating in defensive areas of the market to generate attractive risk-adjusted returns.”

Hadley Peer Marshall, managing partner and co-head of Brookfield’s infrastructure debt and structured solutions businesses, said: “This is a great time to be investing in infrastructure debt. With capital constraints across the market, we are increasingly becoming borrowers’ preferred partner and continue to see a number of interesting opportunities to offer flexible solutions for businesses across the globe.”

To read the latest IPE Real Assets magazine click here.