The Kingdom of Bahrain’s sovereign wealth fund is planning to invest in UK student housing assets through a partnership with investment manager Investcorp.

Bahrain Mumtalakat Holding Company and Investcorp are in talks to jointly own a student housing-focused operating platform created by Investcorp.

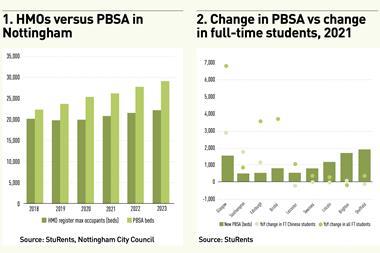

The 1,200-bed platform with assets in Nottingham, Bristol, Exeter and Leeds, manages the refurbishment and leasing of Investcorp’s houses in multiple occupation assets in the UK and helps with their acquisition and underwriting.

The platform intends to acquire an additional 700-1,000 beds annually over the next several years.

Shaikh Abdulla bin Khalifa Al Khalifa, CEO of Mumtalakat, said: “We continue to explore investment opportunities that will add value and grow our portfolio through strategic partnerships.

“By joining hands with Investcorp, we believe that we would be able to further establish a best-in-class investment platform that focuses on fulfilling the increasing demand in the UK for student housing.”

Rishi Kapoor, Investcorp’s co-CEO, said: “We believe that there is a shortage of well-managed, well-maintained, and affordable student HMO assets in major UK university cities.

”Our platform seeks to provide a best-in-class service which benefits the students, parents, the university ecosystem and the towns and cities where we have assets, and we believe that it could be further enhanced by a potential partnership with Mumtalakat.

To read the latest edition of the latest IPE Real Assets magazine click here.