Latest reports – Page 932

-

PropertyEU Archive

PropertyEU ArchiveEditor's letter: Have we got a clue?

'I don’t think political leaders have a detailed grasp on climate change - and I don’t think all that many real estate investment firms do either.'

-

PropertyEU Archive

PropertyEU ArchiveLife Science REIT goes public in largest London listed UK REIT IPO

Life Science REIT announced on Wednesday that it has raised £350 mln (€415 mln) of gross proceeds in its initial public offering on the Alternative Investment Market (AIM) of the London Stock Exchange.

-

PropertyEU Archive

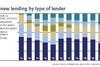

PropertyEU ArchiveCovid backlog and new lenders boost UK financing volumes

UK lenders have been playing catch up in 2021, with backlogs of deals from 2020 boosting first-half lending figures.

-

PropertyEU Archive

PropertyEU ArchiveCovivio unit sells mixed-use portfolio in Italy for €111m

Central Sicaf, a company managed by French property group Covivio, has completed the sale of a portfolio of 17 mixed-use assets to AP Wireless Italia InfraRe, a subsidiary of Radius Global Infrastructure.

-

PropertyEU Archive

PropertyEU ArchiveRental growth and record yield compression boost CTP

Accelerating logistics rental growth and yield compression in Central and Eastern Europe (CEE) are driving strong growth at listed regional specialist CTP.

-

News

KKR, GIP to buy data centre REIT CyrusOne for $15bn

Deal accelerates CyrusOne’s global expansion and helps deliver ’reliable solutions at scale’

-

News

AXA IM Alts European logistics fund raises €800m via green bond

Fundraise follows the issuance of two green bonds by AXA Core Europe earlier this year

-

News

American Tower to buy CoreSite Realty in $10bn deal

Deal will accelerate CoreSite’s US pipeline, ’while also evaluating the potential for international expansion’

-

News

Rockpoint, Resicap to expand US housing JV with $4.5bn deals

Rockpoint to fund investment from opportunistic fund series

-

News

HESTA enters Europe’s living real estate sector

Nuveen teams up with HESTA and Eagle Street to buy Dublin site for $500m BTR development

-

News

EQT Exeter seeks $2.5bn capital raise for core US industrial fund

TCRS approves $200m commitment to Exeter Core Industrial Club Fund IV

-

Special Reports

Special ReportsMacquarie makes €125m debt investment in Irish broadband firm SIRO

Macquarie’s loan is largest institutional component of SIRO’s €620m debt financing package

-

PropertyEU Archive

PropertyEU ArchiveAXA IM Alts’ European logistics fund scores €800m green bond

Alternative investments specialist AXA IM Alts has announced that its flagship European logistics fund, AXA Logistics Europe Master, has successfully priced an €800 mln green bond.

-

PropertyEU Archive

PropertyEU ArchiveGenesta hires head of Nordic residential

Nordic fund and investment manager Genesta has appointed Stefan Björklund to lead its new Nordic residential strategy.

-

PropertyEU Archive

PropertyEU ArchiveKKR and GIP ink €10b deal for global data centre operator

Private equity firm KKR and fund manager Global Infrastructure Partners (GIP) have inked a $15 bn all-cash deal to acquire CyrusOne, a global data centre operator.

-

PropertyEU Archive

PropertyEU ArchiveNuveen buys into Dublin BTR scheme in Irish residential debut

Global investment manager Nuveen Real Estate has bought in to a residential site at Castleforbes Business Park (Castleforbes) in a joint venture with pan-European investment manager Eagle Street Partners and Hesta, the Health Employees Superannuation Trust Australia

-

PropertyEU Archive

PropertyEU ArchiveSupermarket Income shops for €86m of grocery stores

Grocery-focused vehicle Supermarket Income REIT has acquired a Sainsbury’s supermarket in Swansea, South Wales, and a Tesco supermarket in Maidstone, Kent, from Argo Real Estate for a £73 mln (€86 mln).

-

PropertyEU Archive

PropertyEU ArchiveApcoa signals new chief financial officer

Pan-European parking operator Apcoa has appointed Sam Groves as chief financial officer (CFO) of the group.

-

PropertyEU Archive

PropertyEU ArchiveHagag checks into Romanian hotel with 5-star plan

Romania-focused investor-developer Hagag Development Europe has acquired the Susai Hotel, a property located in Predeal, Romania’s most proeminent mountain resort.

-

PropertyEU Archive

PropertyEU ArchiveDemire shareholders mull sale of German firm

Apollo and Wecken & Cie, the principal shareholders in Germany's Deutsche Mittelstand Real Estate (Demire), have confirmed they are considering the sale of the copmany.