Latest reports – Page 878

-

PropertyEU Archive

PropertyEU ArchiveVGP acquires land plots in Germany for shed schemes

VGP, a European provider of logistics and commercial real estate, has unveiled plans to build two industrial parks in Halle (Saale) and Erfurt.

-

PropertyEU Archive

‘Prime shopping centres have now become our most attractive sector’

AEW’s 2022 European Annual Outlook says prime shopping centres have now become the firm’s most attractive sector going forward.

-

PropertyEU Archive

PropertyEU ArchiveInvesco Real Estate snaps up Swedish logistics warehouse

Global asset management firm Invesco has acquired a logistics warehouse facility in Helsingborg, Sweden, on behalf of a UK separate account client.

-

PropertyEU Archive

PropertyEU ArchiveThe great reset

Investors are betting on a post-Covid recovery, but inflation - and possible interest rate rises - are being watched carefully. Meanwhile, ESG-related value-add plays, prime shopping centres, and office occupancy levels are big talking points.

-

PropertyEU Archive

PropertyEU ArchivePalmira purchases German facility for latest fund

European investor and asset manager Palmira Capital Partners has concluded a further acquisition for its Corporate Real Estate Club 2 (UIC 2) in Hainichen, Saxony, in Germany.

-

PropertyEU Archive

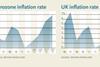

PropertyEU ArchiveInflation reappears after years of absence

As the cost of living soars, so the potential knock-on effect of interest rate rises travel up the agenda. Experts wonder what this means for real estate.

-

PropertyEU Archive

PropertyEU ArchiveReal IS picks up logistics portfolio in Germany

Real IS, the property arm of German lender BayernLB, has acquired the logistics portfolio Quarto from W&B Projektportfolio for its special real estate alternative investment fund (AIF) Themenfonds Deutschland II.

-

News

NewsPSP Investments, Eurazeo to invest €300m in European hotel assets

New partnership agrees to FST Hotels, owner of five Spanish hotels

-

News

SDCL Energy invests in Portuguese biomass project

SDCL also acquires additional projects in Oliva Spanish Cogeneration for €12m

-

News

BC Partners makes debut Italian real estate investment

BCPERE I fund and Kervis buy portfolio in downtown Milan from Bocconi University

-

News

Switzerland’s AFIAA buys office and commercial building in Lisbon

Swiss foundation for international real estate investments buys 242 Avenida da Liberdade

-

News

GLIL Infrastructure invests in Irish wind farms via Invis Energy

Investment is GLIL’s first major transaction outside of the UK

-

News

Mastern Asset Management snaps up Alpharium Tower in Seoul

ARA Korea sells office tower in Pangyo Business District for KRW1.02trn

-

News

NewsTishman Speyer buys mixed-use property in German from Allianz

Tishman buys asset at Friedrichstrasse 76-78 in Berlin on behalf of its TSEV VIII and co-investment partners

-

News

HIH Invest sells Crown Center office in Brussels to Eaglestone

HIH Invest acquired property at Rue Royale 138 in 2011 on behalf of a closed-end real estate fund

-

PropertyEU Archive

PropertyEU ArchiveBNP Paribas launches data centres team with key appointment

BNP Paribas Real Estate (BNPPRE) has appointed Michael Umfreville to lead a new team focused on the leasing and land acquisitions of data centres across the UK.

-

PropertyEU Archive

PropertyEU ArchiveTishman Speyer acquires prime mixed-use opportunity in Berlin

Global real estate player Tishman Speyer has acquired Q207 at Friedrichstrasse 76-78, a landmark commercial property in central Berlin, from Allianz Real Estate, acting on behalf of several Allianz group companies.

-

PropertyEU Archive

PropertyEU ArchiveAFIAA acquires Lisbon office and commercial asset

Swiss Investment Foundation AFIAA has acquired the 242 Avenida da Liberdade office and commercial building in Lisbon by way of an asset deal.

-

PropertyEU Archive

PropertyEU ArchiveM7 selects managing director for Germany

Pan-European investor and asset manager M7 Real Estate has appointed Peter Wenzel as managing director, Germany, as the company continues its growth in this region.

-

PropertyEU Archive

PropertyEU ArchiveGermany's Argentus and Westbridge merge to form major ESG advisory

Argentus and Westbridge Advisory, the German, independent companies specialising in the areas of sustainability and the optimisation of operating costs for properties, have announced plans to join forces.