Latest reports – Page 445

-

PropertyEU Archive

PropertyEU ArchiveArdian to diversify beyond offices

French private investment house Ardian is to expand its portfolio beyond offices to include new asset classes including self-storage, residential and data centres.

-

PropertyEU Archive

PropertyEU ArchiveCA Immo spins off German construction management subsidiary

CA Immo has taken a further step in its strategy to simplify the company's business structure and to focus on core activities with the spin-off of its wholly owned construction management subsidiary omniCon Gesellschaft für innovatives Bauen mbH via a Management-Buy-Out.

-

PropertyEU Archive

PropertyEU ArchiveBreakthrough secures €121m loan for new life sciences project in Cambridge

Global life sciences real estate developer, owner and operator Breakthrough Properties is set to begin construction on Vitrum by Breakthrough, a life science building located inside the 21-acre St. John’s Innovation Park in Cambridge, England.

-

PropertyEU Archive

PropertyEU ArchiveP3 Logistic Parks acquires 62,300 m2 warehouse project in the Netherlands

Logistics specialist P3 Logistics Parks has bought a 62,300 m2 development asset located in an established logistics park in Herkenbosch, the Netherlands, for an undisclosed amount.

-

PropertyEU Archive

PropertyEU ArchiveFrance and the Netherlands to offer best logistics opportunities in 2024

The European markets set to provide the greatest value opportunities in 2024 are France and the Netherlands, both of which have seen rental growth above 30% since Q1 2022, according to advisor Savills.

-

News

NewsNordic investor Slättö buys Helsinki office for aparthotel conversion

Catella Real Estate sells asset acquired in 2011 for Catella Scandia Chances fund

-

News

NewsCabot targets $3.5bn logistics investment with $1.6bn fund closure

Value Fund VII represents Cabot’s largest fund to date

-

News

NewsAEW acquires two Spanish logistics assets in Barcelona

TCC sells two assets in Spain to AEW’s Eurocore and Logistis funds

-

News

NewsBlackRock’s CFP funds solar expansion in Asia Pacific with Ditrolic Energy

Climate Finance Partnership is backing Ditrolic to build C&I and utility-scale solar projects

-

News

NewsCubico boosts development pipeline in Mexico with 1.6GW renewables deal

Canadian pensions-owned renewables company acquires Renantis Mexico

-

News

NewsLendlease’s Darling Square shopping centre sells for A$88m

Darling Square mall was on the market last October, reportedly with a A$95m asking price

-

News

NewsBrookfield and BTG Pactual snap up $300m in Brazil logistics from GLP

GLP Capital Partners sells 12 logistics assets in two separate transactions

-

News

NewsBarings acquires Lisbon site for 85,000sqm logistics park

Manager buys 210,000sqm plot in Santa Iria de Azoia for BREEVA II

-

News

NewsCapitaLand sells 95% of Beijing office tower to AIA Life for RMB2.4bn

CLI holds the remaining 5% interest in the Beijing office tower

-

PropertyEU Archive

PropertyEU ArchiveNew tool aims to standardise carbon measurement of buildings across Europe

A new methodology for measuring the carbon footprint of buildings throughout their entire life cycle has been launched in eight European countries as part of industry efforts to decarbonise real estate.

-

PropertyEU Archive

PropertyEU ArchiveBarings strikes deal for value add fund in 'heavily corrected market'

Barings, one of the largest diversified real estate investment managers, has been selective for its value add fund BREEVA II, but has made an investment in Portugal in the logistics sector.

-

PropertyEU Archive

PropertyEU ArchiveHeimdal Nordic establishes new credit fund for Danish RE, backed by PenSam

Heimdal Nordic has introduced the Heimdal Credit Fund (HCF), a credit vehicle that focuses on providing loans to the professional real estate market in Denmark.

-

PropertyEU Archive

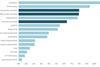

PropertyEU ArchiveJLL 2024 outlook: investors face balancing act between asset management and desire to deploy

Perhaps the biggest undertaking for real estate investors in 2024 will be to balance the financial and asset management challenges within their existing portfolios, with the desire to deploy capital to in-demand assets and take advantage of opportunities over the next 12 to 24 months.

-

PropertyEU Archive

PropertyEU ArchivePalmira sets its sights on next fund

Frankfurt-based Palmira Capital is in the process of launching another fund after completing the investment programme for current iteration, European Core Logistics Fund (ECLF).

-

PropertyEU Archive

PropertyEU ArchiveFranklin Real Asset Advisors buys package of UK care homes, deal was six months in the making

Franklin Real Asset Advisors has acquired six UK care homes on behalf of Franklin Templeton Social Infrastructure Strategy.