Perhaps the biggest undertaking for real estate investors in 2024 will be to balance the financial and asset management challenges within their existing portfolios, with the desire to deploy capital to in-demand assets and take advantage of opportunities over the next 12 to 24 months.

That is one of the key points made by JLL in its Global Real Estate Outlook.

The property services firm says a defining characteristic of successful investors will be ‘ambidexterity’: the ability to execute offensive and defensive strategies, effectively deploy resources, and make decisions with conviction in a still uncertain climate. Many investment managers are having to contend with zero-to-negative return vintages, creating additional challenges including talent retention, it adds.

The report continues: ‘While the outlook for the year ahead is complex, nuanced, and suggests uneven performance, the overriding theme in real estate markets will be one of opportunity amid the challenges.’

‘Relative stability in the macroeconomic environment will offer opportunities for investors and occupiers to execute real estate strategies that were unrealistic to implement in 2022 and 2023. While we do expect continued volatility, the extreme post-pandemic highs and lows in the sector will moderate and offer more predictable outcomes, supporting activity by actors across the real estate life cycle. Those who can manage through existing challenges and the lingering uncertainty, while making decisions with conviction and executing on longer-term strategic priorities, will have a window to excel.’

JLL adds that in 2024 there will be a continuation of the bottoming-out phase of non-synchronous real estate cycles across geographies and sectors.

Stronger market segments with structural tailwinds are likely to power through, while 2023’s more challenged sectors search for green shoots as 2024 progresses. Geopolitics, domestic politics, and regulation will be critical to watch closely in 2024 as well. There will be more national elections in the coming year around the world than ever before.

Optimism

The agent echoes other firms that feel a corner has been turned.

‘Despite recent challenges and likely bumps in the road ahead, there are reasons for optimism as we turn the pages of our calendars to 2024. The longer-range outlook for the industry is bright as well, driven by the secular macro trends that have already been guiding the growth of the sector. The evolving future of work, increase in real estate outsourcing, continued capital flows, changing shape of urbanization, accelerating technology, and commitment to sustainability – will shape the real estate landscape for the rest of the decade.’

Sectors

Opportunities for growth exist in pockets of sectors and geographical micro-markets, and there will be opportunities in distress and portfolio rebalancing efforts, it says, with JLL calling the Living sectors a 'bright spot' in 2024 and beyond for many reasons.

An expanding world population is becoming more urban, meaning cities require more homes, as well as a broader range of household types and sizes. Long-term structural trends like ageing populations, demand for education, and housing availability remain critical drivers of housing demand and will continue to benefit Living investment strategies across more markets globally. In the near-term in 2024, some markets will see distress and micro over-supply situations as interest rates and concentrated new construction in growth markets have an impact.

Meanwhile, the growing emphasis on regionalization and local manufacturing will continue in 2024, as efforts to bring production closer to the customer and diversify supply chains broaden. The evolving global landscape of government incentives will bring new manufacturing into the advanced economies of North America and Europe, driving demand for industrial and logistics facilities.

And, retail is poised for an evolving comeback in 2024. Investors are returning to a sector that earlier in the cycle transformed its supply-and-demand dynamics and its yield and rental profile to offer attractive returns and opportunities for renewed rental growth. In the US. high-quality, well-located retail – especially grocery-anchored – has been one of the top performing segments, with increasing investor allocations as consumers remain resilient from COVID-era stimulus amid strong job and wage growth. In Europe, the continued rebound in travel and tourism, and the return of positive real wage growth as inflation falls, will support turnover at a time of otherwise soft economic conditions.

One of the hottest segments is the global data center market, which is forecast to be one of the fastest-growing sectors across many geographies through to 2026, and also one undergoing continued change.

The evolution of artificial intelligence (AI) from excitement and hype in 2023 into rational and strategic adoption in 2024 – within the real estate sector and beyond – will drive both an acceleration in requirements for the number of data centers, as well as changes in location, construction, and operating criteria for individual centers.

JLL says AI infrastructure site selection criteria favors lower energy prices and lower land costs, and facilities in the AI era will increasingly need to accommodate evolving hardware needs such as advanced cooling facilities.

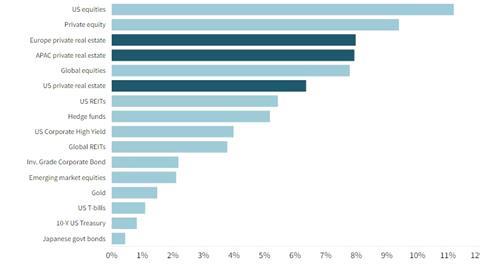

*The graphic shown depicts 10-year annualised returns by asset class. European private real estate sits in third place, APAC private real estate in fourth, US private real estate in sixth, and UK REITs in seventh. US equities and private equity take the first two spots.