Latest Analysis – Page 23

-

Analysis

AnalysisAnalysis: China relaxes rules for foreign property investors

What does the reversal of real estate restrictions mean for the market?

-

Analysis

AnalysisAnalysis: Blackstone shines light on booming Nordic market

The $3bn investment in Agasti is the biggest in a recent surge in regional activity

-

Analysis

AnalysisAnalysis: Should fundraising exuberance serve as a warning?

Capital raising numbers for value-add strategies are close to 2007 highs

-

Magazine

MagazineA coming of age

The launch of the Global Infrastructure Investor Association (GIIA) by 25 institutional investors and investment managers reflects the growing maturity of the infrastructure market

-

Analysis

AnalysisAnalysis: Competition prompts SWFs to alter course on real assets

Investors moving out of comfort zone, says JP Morgan’s head of sovereigns

-

Analysis

AnalysisBetting on the house

Industrial real estate markets have become busy of late. Much has been written about how the rise of online commerce will boost the logistics sector. But the recent transactional activity boils down to one primary factor – the greater yields offered by industrial property

-

Analysis

AnalysisAnalysis: Kaisa default portends Chinese housing stress

Chinese developer may soon be forced to enter bankruptcy proceedings

-

Analysis

AnalysisINREV conference: Technology, obsolescence and ‘skeuomorphism’

Delegates in Barcelona learn new trends – and new words

-

Analysis

AnalysisAnalysis: Is Blackstone too big?

Multi-billion GE sale prompts questions about systemic risk posed by company

-

Analysis

AnalysisPension funds move quickly on residential conversions

First Property returns 53% for Towers Watson clients

-

Analysis

AnalysisMIPIM: US investors change their thinking on Europe

Pension funds looking to diversification, not just opportunistic returns

-

Analysis

AnalysisBlurring the lines

Real estate and infrastructure investment effectively exist in two separate worlds – despite often sharing the same physical space. Allocations to both asset classes are invariably kept separate despite the underlying assets making up much of the built environment.

-

Magazine

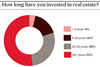

MagazineKPMG survey: Investors embrace diversity

Now in its fourth year, the survey has been designed as a prelude to the annual Re-Invest Summit held in Cannes. Here are the results

-

Magazine

MagazineKPMG survey: Hypothetical results

What is striking from the results is the complete lack of consensus when investors are presented with the below statements Whether a question of continued commitment to core in the face of tightening yield; or whether Europe’s peripheral economies can deliver the real estate fundamentals to support investment ...

-

Analysis

AnalysisAnalysis: Property derivatives fund gives money back to investors

Why InProp has exited the UK property futures market

-

Analysis

AnalysisIndebted Chinese developer raises doubts over stability of market

Kaisa CEO resigns following sale of Shanghai projects

-

Analysis

AnalysisHere to stay

IP Real Estate first published its Special Issue on real estate debt at the beginning of 2012. It has since tracked what is, in effect, the emergence of a new institutional asset class in Europe.

-

Magazine

Regulation: A necessary evil?

Proposals to head off the next UK commercial property crash by implementing a national debt database continue to generate debate. Russell Handy reports

-

News

NewsManhattan office to trade for $2.25bn as market nears pre-crisis levels

Purchase of 1095 Avenue of the Americas expected by Ivanhoé Cambridge consortium

-

News

Restoring faith in pensions: Show them, and they shall believe

Is infrastructure the best way to restore consumers’ faith in pensions?