All Investment Vehicles articles – Page 4

-

-

Opinion Pieces

Opinion PiecesGuest view: Property fund managers need comprehensive ESG disclosures

Managers that proclaim sustainability credentials of funds must also operate them sustainably

-

News

NewsHines on track to bust fundraising target for European value fund

The fund’s investment period runs until mid-2026

-

News

NewsHIH Invest acquires day nursery in Leipzig for open-ended institutional fund

The Article 8 fund HIH Zukunft Invest is still in its investment phase

-

News

NewsCoima wins tender for major Milan regeneration site

The site will be integrated with the surrounding Porta Nuova neighbourhood

-

News

NewsKKR to invest in PangeaCo to create Perú’s largest fibre-optic network

KKR will own a 54% controlling interest in Perú’s first independent open-access network

-

News

NewsCromwell Property and Australian Unity Property create A$1.1bn property fund

When merged, the enlarged fund will have a combined portfolio of 15 diversified assets across Australia

-

News

NewsNYSCRF adds Waterton and Antin to manager lineup

Waterton Residential Property Venture XV gets $300m and Antin Infrastructure Partners V gets $250m

-

Magazine

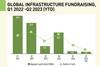

MagazineInfrastructure fundraising: Where has all the money gone?

Infrastructure fundraising has ground to a halt as investors peer into the valuations void. Christopher Walker reports

-

News

NewsDexus smashes fundraising target with A$200m capital raise for wholesale airport fund

The fund owns a 1% stake in Australia Pacific Airports Corporation (APAC), the unlisted holding company of Melbourne Airport and Launceston Airport

-

News

NewsEuropean real estate funds post third consecutive quarter of negative returns

INREV Quarterly Fund Index records a total return of -0.97% in the first three months of 2023

-

News

NewsMadison to provide liquidity to real estate investment management platforms

Firm launches new strategy offering liquidity solutions and growth capital to property fund sponsors

-

News

NewsPennsylvania PSERS backs PIMCO real estate debt fund with $200m commitment

PIMCO raises $2.8bn for US real estate credit strategy, according to board meeting document

-

News

NewsSwiss Life’s European healthcare real estate fund enters the UK

More transactions in the UK planned for pan-European strategy managed from Paris

-

News

NewsOhio PERS to reduce separate accounts in favour of open-ended funds

Pension fund to up exposure at a time of growing redemptions among core real estate vehicles

-

Opinion Pieces

Opinion PiecesGuest view: Let’s get the UK’s Reserved Investor Fund done

The RIF presents transformative opportunities for UK fund managers, writes Melville Rodrigues

-

Magazine

MagazineCore real estate: All change in Australia

Australia’s core real estate fund sector has been transformed by a recent spate of M&A. Florence Chong surveys the aftermath

-

Magazine

MagazineCore real estate: Asia-Pacific becomes a global safe haven

Asia-Pacific was seen as more volatile than the US and Europe. But the region looks like a beacon of stability, writes Florence Chong

-

Magazine

MagazineCore real estate: Can Europe’s ODCE funds stay on track?

The growth of Pan-European core real estate funds has looked unstoppable over the past decade. Does the current market situation threaten to derail things? Christopher Walker reports

-

Interviews

InterviewsCore real estate: A European ODCE evolution

The European ODCE index has been maturing as well as growing. Christopher Walker speaks to Iryna Pylypchuk