The US cities face big a problem with class-B offices. But the situation could generate opportunities for innovation and cooperation, write Alexis Crow and Byron Carlock

The confluence of several dynamics – some of which predated the pandemic, some of which have been exacerbated during pandemic and some of which have emanated from recent banking wobbles – have led some market participants to portend a coming ‘Armageddon’ in the office segment of commercial real estate.

In the US, the secular shifts to remote and hybrid working jolted the real estate industry, as many leading investors and developers wondered whether demand would ever recover for office space (and office-anchored retail). Looking to the supply side, the US is particularly beleaguered by a glut in class-B office stock – that is, ossified office buildings, many of which were constructed in the aesthetically-lean 1970s. Given the datedness of these edifices, much of US class-B office stock has been historically starved of capital, and is thus largely ill-equipped to cater toward changing patterns of demand for ESG and technology-driven working spaces.

On the financial side, recent bank wobbles have laid bare the exposure of some small lenders to commercial real estate – particularly, office and office retail. Rising interest rates and concerns about the trajectory of economic growth – combined with the impacts of the structural shifts to teleworking – had already brought lending to a standstill in Q4 2022. Thus, even prior to the bank collapses in March 2023, lenders were largely unwilling to deploy capital to a sector undergoing secular shockwaves, and potentially for overvalued assets. Indeed, asset price inflation which predated the pandemic has continued – and is even applicable to afflicted sectors such as office buildings. Amidst an elevated price backdrop, we are currently operating in a frozen market in the US (unlike in Europe, as we explore below), with a lot of room for price discovery between buyers and sellers. As larger US lenders reduce their exposure to commercial real estate and signal potential losses on the horizon, any meaningful dip in prices – combined with a cascade of delinquencies – could trigger an overt loss of confidence in the US market. Hence, looking beyond the bank wobbles – which appear to be contained – the proverbial ‘other shoe’ might well drop.

The opportunity: rethink and reimagine

Nevertheless, the ‘great sag’ – and potential underlying financial fragility – with US office stock does not necessarily portend the calamity that others have forecasted. In terms of the market outlook, although we are likely to witness geographical and asset-specific pockets of distress, this does not appear to spell a reprise of the ‘all boats overboard’ moments of 2008 (in part due to regulation implemented in the wake of the global financial crisis, large US banks are in much better standing and loan-to-value ratios are healthier). At the asset level, the fact that the American office market is a laggard vis-a-vis its European peers actually presents an opportunity for equity-heavy investors — especially those well-poised in the proptech space to equip properties for climate resilience via savvy digital adoption.

The smartest capital is likely to be deployed to the most vibrant central business districts (CBDs) — the deployment of which creates a distinct opportunity for the next cycle. Rethinking and reimagining our business communities is not the sole preserve of real estate developers: forward-thinking municipal authorities, as well as infrastructure investors, will have a significant role to play. As we equip our cities and buildings for climate resilience and for new ways of working, proptech investors will also be presented with significant opportunities for scaling their investments – in an age of secular shocks, this might be termed ad-venture capital! Lastly, as we conclude, reimagining our professional urban environments will require improvements in public safety – a critical and decisive factor in determining the attraction of specific markets for durable investment over a long horizon.

The financial picture: potential pockets of instability

Since the start of the COVID-19 pandemic and the rapid adoption of remote working, many of the world’s most prominent investors have voiced their concerns about steep losses in the office sector. In spring 2020, our forecast was for many white-collar services jobs to converge toward a three-day office work week, which might result in about a 10% decline in footprint – and hence a meaningful drop in prices. Over three years later – and amidst a widespread adoption of hybrid working for many CBD office tenants – we’ve not yet witnessed a significant plunge in asset prices in the US market, where prices remain elevated (the US Federal Reserve continues to point to elevated prices across the real estate landscape in the US, including office and office-anchored retail).

By contrast, transaction volumes in Europe have held relatively steady throughout the pandemic economy years, and some investors have already taken mark-to-market losses. Unlike in the US, assets are still trading, and notwithstanding potential pockets of overvaluation in some key cities, the office building stock is arguably markedly better in European markets, as many structures were built to stand the test of time.

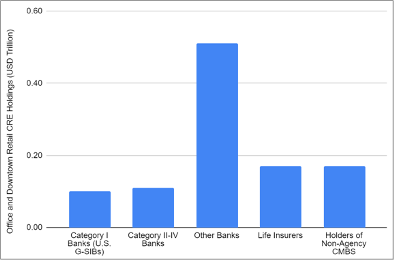

The onset of the recent bank wobbles in the US – reverberating through portfolios in recent months – have raised the questions of whether such a moratorium on price discovery can continue and whether the US commercial real estate market might be the locus of the next wave of financial distress. Many have pointed to the linkages between the smaller banks in the US and the commercial real estate landscape. As can be seen in Figure 1, the country’s smaller lenders have deep exposure to office and office-adjacent retail, in contrast with America’s larger banks, where such assets make up a more modest component of total portfolios.

Figure 1: Lenders’ exposure to US office and downtown retail, Q4 2022 (US$)

Our base case is that the wave of consolidation amongst the smaller banks in the US remains contained. However, some of these lenders have already commenced offloading loans at a loss, signalling the potential for writedowns and hence a softening of prices across the office landscape.

Also, in contrast with the European market, a potentially worrisome development – and a feature of the unique hyper-financialisation of the US market – is that of securitisation and US commercial real estate. Although commercial mortgage-backed securities (CMBS) are not as dominant in the pre-GFC heyday, non-agency holders of CMBS still comprise 15% of outstanding loans to office and office-anchored retail in the US, and hold about $500bn of assets in the space.

These are not insignificant numbers. The problem with securitisation is that it implies liquidity, and in the event of defaults or delinquencies as some office-related loans reach maturity the CMBS market is prey to redemption risk, and hence may spur bouts of financial instability. Although ripple effects in the market may not become a torrent, cascade or ‘bubble bursting’, a loss of confidence precipitated by softening prices or a rush to the exit of office-related CMBS may be enough to create distress (and hence opportunities for alternative forms of credit, thus prolonging the trend of financialisation).

Asset price landscape: Mark-to-market losses?

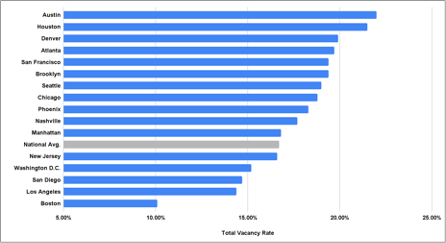

The potential for such distress to emerge in the US is likely to differ from market to market, with the potential for sharp divisions even within specific markets. For example, much Sturm und Drang has been made about the fate of office space in downtown Los Angeles, but Century City remains a ‘shining star’, as professional and legal services firms flock to the submarket’s class-A buildings. As shown in Figure 2, vacancy rates remain high in tech-heavy CBDs, including San Francisco and Austin. Vacancy rates are also elevated in cities which continue to confront public safety issues, such as Chicago.

Figure 2: Office vacancy rates, US metro areas (April 2023)

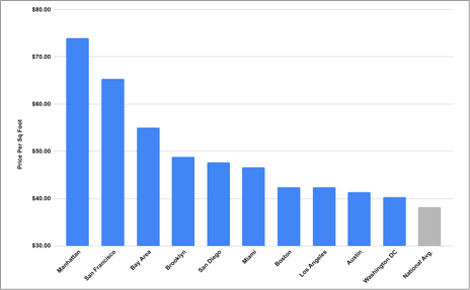

However, asset prices remain significantly elevated – even in some of the hardest-hit CBDs, such as San Francisco. Office buildings in the Golden Gate city still command some of the highest prices in the US, usually standing neck and neck with Manhattan (see Figure 3).

Figure 3: Office space price per sqft, US metro areas (April 2023)

The spread between prices and vacancy rates in CBDs most vulnerable to secular shifts, such as San Francisco, means that the other shoe may eventually drop. The trigger might be a wave of defaults on one CBD, which might then have a domino effect on markets which are overpriced, ‘overcrimed’ and under-leased.

At the asset level: flight to quality

As indicated, America has a problem with its existing class-B office stock. A refusal to acknowledge obsolescence predated the pandemic and has continued even during the secular shocks from WFH, an elevated price environment and a frozen trading landscape. Although some optimists have pointed to the potential for such ossified office buildings to be turned into residential units (thus also alleviating the issue of a chronic shortage of affordable housing in the US), the top affordable housing developers have cited the structural challenges of such conversions.

This means a significant portion of class-B office buildings will be rendered obsolete. One prominent executive points to pockets of “purgatory” in the US office landscape, and estimates that as much of 20% of the market will “have the keys handed in”.

European offices: ESG and la longue durée

By contrast, European office stock seems to be standing the test of time, as it increasingly caters toward investor preferences for environmental protocols. This might be a function of the assets themselves (as buildings were constructed for la longue durée), the lending profile (European banks bear the lion’s share of exposure to commercial real estate, and their portfolios are subject to mounting climate regulations and stress testing), investor preferences (such as mandates from pension funds), or a combination of the three. Thus, European office stock is arguably better positioned to weather the climate storm – emanating from regulation and/or investor preferences – which stands in contrast with the overhang of class-B office stock.

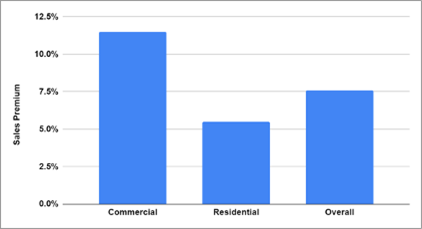

In fact, as shown in Figure 4, an examination of sales data from markets across the globe (including the US) reveals that investors in commercial real estate are willing to pay a ‘green premium’ for high quality assets which can fulfill certain environmental qualifications.

This suggests that an immense opportunity might unfold to rethink, reimagine and potentially future-proof America’s office stock for enhanced climate resilience and to cater to shifting investor preferences.

Conclusion: opportunities for cooperation and innovation

In sum, in considering the demand shocks rendered to the US commercial real estate market by the pandemic-induced shifts to teleworking, the verdict is still out on just how much space will be required by tenants in America’s CBDs. As some prominent companies increase their requirements for ‘return to office’, others are actually increasing childcare offered on site – with the belief that the ability for working parents to come to the office has a positive impact on productivity and wellbeing. Indeed, a close reading of data on productivity levels during the pandemic-economy years evidences that the gains experienced in the early waves of COVID-19 – when many white collar workers could work from home and thus save on commuting time – actually erodes over time, in part due to a lack of in-person collaboration.

People need offices – to bind together as a professional and organisational cultures – and need spaces to convene for whiteboarding, brainstorming, mentoring and apprenticeship, as well as product education and socialisation. Recognising this need, and the continuing relationship between office space, professional culture, and productivity, we are hopeful that America’s current class-B problem – and pockets of potential financial instability – will actually open up an opportunity for the convergence between thoughtful city planning, cooperation between public, private and philanthropic interests, evidence of which we have witnessed in thriving urban centres including Dallas, Nashville, Salt Lake City and Indianapolis.

Lastly, any bouts of financial distress – or severe losses in the office and office-anchored retail space – set against the backdrop of a higher rate environment might just yield the advent of opportunistic funds and alternative forms of credit to step in where the markets have retracted. This might be termed ‘ad-venture’ capital, for those courageous enough to take advantage of a potential reversal in the market – for future cycles in the built environment.