All articles by Christopher Walker – Page 6

-

Analysis

AnalysisM&A: The race is on to get bigger in infrastructure fund management

Does the BlackRock-GIP merger mark the start of an infrastructure arms race? Christopher Walker and Richard Lowe report

-

Special Reports

Special ReportsQ&A: Bruntwood SciTech

Bruntwood SciTech aims to support the UK’s ambition to become a global science and technology superpower. Christopher Walker talks to Ciara Keeling, Wes Erlam and Kevin Etchells

-

Special Reports

Special ReportsEuropean life-science real estate: a market catching up fast

The sector in Europe is some way behind that in the UK and US, but Christopher Walker reports that the gap is narrowing

-

Special Reports

Special ReportsEuropean student housing: Markets divided by rent control

Investment opportunities across Europe are enormous, but Christopher Walker finds a market divided by levels of rent control

-

Special Reports

Special ReportsKadans Science Partner: The trailblazing specialist developer

After buying a Dutch university subsidiary in 2009, Kadans has grown to become a trailblazing European developer. Christopher Walker talks to CEO Michel Leemhuis

-

Interviews

InterviewsQ&A: Oxford University Development

Christopher Walker talks to Anna Strongman, Chas Bountra and Wes Erlam about the joint venture between Oxford University and Legal & General

-

Special Reports

Special ReportsThe UK life-science real estate market evolves fast

The market is being led by the ‘golden triangle’ – and potentially emerging regions within the country. Christopher Walker reports

-

Special Reports

Special ReportsUS student housing: Investors need to do their homework

The outlook for student housing in the US looks good, but the sector comes with some unique challenges. Christopher Walker reports

-

Special Reports

Special ReportsAffordable housing: Scotland prompts the law of unintended consequences

Well-intentioned initiatives by the Scottish government to control rents have backfired, with knock-on effects for student housing. Christopher Walker reports

-

Special Reports

Special ReportsAffordable housing: PGIM seeks to serve the ‘forgotten majority’

Oscar Kingsbury tells Christopher Walker why PGIM has a laser focus on single-family affordable homes in the UK

-

Special Reports

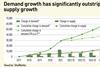

Special ReportsCan institutional investment in affordable housing keep up with demand?

Institutional investors have been homing in on affordable housing. But the need is only growing stronger. Christopher Walker reports

-

Special Reports

Special ReportsWhat the biodiversity agenda means for forestry and agriculture

Biodiversity is rising up the agenda of institutional investors. Christopher Walker explores what it means for forestry and agriculture

-

Magazine

MagazineSocial infrastructure: Asset class on the rise

Investors are looking to increase their exposure to social infrastructure, but the sector is complex and requires a careful approach, writes Christopher Walker

-

Special Reports

Special ReportsForest Investment Associates: ‘most exciting time’ for sustainable forestry

Mike Cerchiaro tells Christopher Walker that the asset class has never been in such demand

-

Special Reports

Special ReportsOntario Teachers: A decade in building natural resources exposure

Christopher Metrakos explains the Canadian giant’s natural capital strategy to Christopher Walker

-

Special Reports

Special ReportsCDPQ: Quebec investor pursues sustainable land strategy

Nicolas Leyssieux tells Christopher Walker about CDPQ’s plans to invest C$2bn by 2025

-

Analysis

AnalysisReal estate 2024 outlook (part two): Interest rates, sectors and asset allocation

Outlook for real estate depends on central banks, sector differentiation and wider asset allocation forces

-

Analysis

AnalysisReal estate 2024 outlook (part one): Things can only get better?

It has been a year to forget for investors. Christopher Walker reviews what 2023 means for real estate markets in 2024

-

Analysis

AnalysisCOP28 reaction: A ‘shuffle’ rather than a step forward

Investors read between the lines of ‘transitioning away from fossil fuels in energy systems’

-

Interviews

InterviewsLocal Pensions Partnership Investments: The benefits of scale in action

LPPI was formed in 2016 to help aggregate local authority pension fund money. Today, it manages some £5bn in infrastructure