It has been a year to forget for investors. In the first of a two-part series, Christopher Walker reviews what 2023 means for real estate markets in 2024

Tom Leahy, head of EMEA real assets at MSCI Real Estate Research, sums up the situation with considerable understatement: “2023 has not exactly been a vintage year for real estate.”

It has been year when it felt like the foundations were shifting under the feet of the industry, as rising interest rates and the consequent withdrawal of debt from the market led to repricing and poor performance.

MSCI’s Europe Quarterly Property Index recorded a -9.5% total return for the first nine months of 2023, while annualised capital growth in the major markets of France, Germany and the UK fell well into double-digit declines of -14.8%, -13.5% and -15.8%, respectively. The situation in the US has been similarly gloomy. According to NCREIF Property Index, real estate values fell 11.03% from the second quarter of 2022 to the third quarter of 2023. The total return for the past four quarters was -8.35%.

Valuation uncertainty has been the overriding theme for investors, as prospective buyers avoid paying too high a price in a falling market and sellers do not want to accept the sharp discounts that buyers need to feel comfortable. This has been reflected in a sharp drop in transactions. The volume of completed transactions in the third quarter of 2023 fell 57% on the same period in 2022 and MSCI said it was the “weakest activity since 2010”.

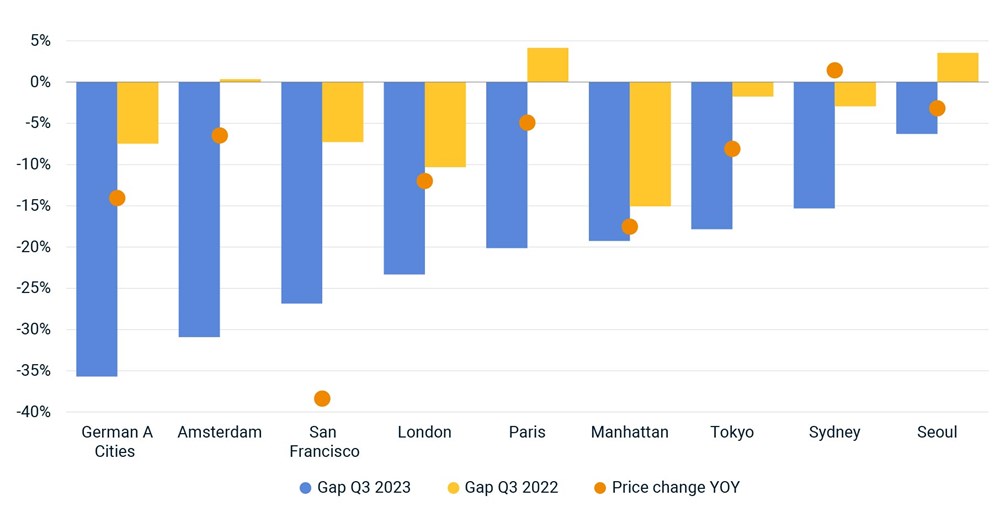

An investor looking to dispose of a property in recent months has had little certainty as to what the correct price should be. To get a handle on the direction of travel, MSCI has developed what it calls price expectation gap models. “We seek to model the expectation gap between buyers and sellers over particular assets in all of the main markets,” says Leahy. “The biggest gaps remain in the offices market – particularly, in the UK and Germany.”

Gap between buyers’ and sellers’ pricing views of offices in different cities

Looking at Germany’s seven so-called A cities – Berlin, Munich, Frankfurt, Stuttgart, Cologne, Düsseldorf and Hamburg – that gap is as much as 35% at present (see chart). “This tells us that sellers would have to significantly reduce asking prices to bring buyers back into the market and move liquidity back towards its long-run average,” says Leahy.

This has been borne out by recent market activity. For example, New London House, an office building in the City of London, recently sold for some 20% less than its original asking price. And the comment holds some validity for commercial real estate in general across Europe.

“At the moment, the transactions are just not happening because bid and ask prices have not adjusted to the impact of rising interest rates,” says Sebastiano Ferrante, head of Europe at PGIM Real Estate. “I expect a drop of something like 5% to 10% in valuations across Europe on average.”

According to the latest UK consensus forecast from the Investment Property Forum, in November investors were forecasting 5% total return for all UK property and a small drop in capital values of 0.2%, although offices and shopping centres are expected to fall further, at -2.8% and -2.2%, respectively.

The Pension Real Estate Association (PREA) recently released the latest results of its Consensus Forecast survey. This showed valuations falling 11.8% in 2023, led by the collapse of the office sector (down 22.3%). The 2024 outlook was predicted to be a shallower fall in valuations of 4.5%, with offices likely to be down a further 11%.

Hope and distress

There is some hope on the horizon. Distress is an important mechanism for price discovery and that might be beginning to emerge. An obvious example is Austrian property group Signa, which has been the biggest seller of European real estate this year and was caught out by the rapid rise in interest rates. Swedish property developer and manager Heimstaden Bostad has been another high profile casualty.

“There are particular markets where this is going on at present,” says Leahy. “Sweden stands out as a market where listed property companies are falling under the weight of too much floating-rate debt and this is starting to create buyer opportunities, particularly for the opportunity funds.”

Fortunately, the timeline for distress to impact valuation adjustments seems also to have shifted from what it was during the global financial crisis. Then it took some two to three years for distress to feed through. “It is possible that banks and other lenders may enforce sooner given the changed interest rate environment,” says Leahy.

Paul Gibson, CIO for EMEA direct real estate strategies at CBRE Investment Management, says: “The pieces are in place for transaction volumes to pick up in 2024, although it may take a while for typical levels to be reached. Valuation declines have further to run as first movers won’t bite on an opportunity unless it feels like a distressed sale. ‘Commodity’ buildings that do not meet the needs of an increasingly discerning occupier and/or tightening environmental regulations will suffer most severely.”

Vincent Nobel, head of asset-based lending at Federated Hermes, says: “This an important theme for next year – a continuing divergence between assets that can find buyers and lenders, and those that cannot. 2024 may be another rocky ride for those investors holding assets that underperform in the eyes of an ever-more discriminating investor base.”

Perhaps this is why, despite real estate debt costs having ballooned, M&G has observed that “distress has been limited to date”. In its 2024 real estate outlook, the fund manager “anticipates forced sales over the next few years with 30-40% of commercial real estate loans across the UK and Europe due to be renegotiated by the end of 2025 at significantly higher rates than borrowers currently enjoy”.

Ferrante sums up the situation: “I think revaluation of assets and low transactions will be the two main themes for 2024. Most of the action we will see will be in distressed assets and in recapitalisations which will be the only real areas of opportunity in the coming year. Overall, I think 2024 will be just as challenging as 2023. The market will be dominated by low liquidity, low transaction volumes and further price correction.”