BlackRock and Singapore’s GIC have formed an equal partnership to buy a UK gas pipeline business from Antin Infrastructure Partners.

Antin said it has agreed to sell Kellas Midstream to BlackRock’s Global Energy & Power Infrastructure Funds (GEPIF III) and the sovereign wealth fund for an undisclosed sum.

Kellas Midstream’s UK Central and Southern North Sea gas infrastructure include the Central Area Transmission System (CATS), the Esmond Transportation System (ETS) and the Humber Gathering System (HGS).

The business was formed when Antin initially acquired a 63% stake in CATS from BG Group in 2014 for £562m (€656m), and later buying a 36% stake from BP in 2015 for £324m.

Over the years, Antin grew the platform both via organic growth with connection to new gas fields and by expansion in the UK Southern North Sea with the ETS acquisition and the HGS development.

Late last year, the name CATS Management was changed to Kellas Midstream.

Mark Crosbie, Antin’s managing partner, said: “We are proud of the significant growth and strategic transformation accomplished during Antin’s ownership over the past five years.

“We are also grateful for the strong partnership and outstanding performance of Kellas Midstream’s talented management team and dedicated employees.”

Andy Hessell, Kellas Midstream’s managing director, said: “GIC and the BlackRock GEPIF team recognise the growth potential of the business we have built and share our strategy to continue to invest, grow and build our portfolio of midstream assets and serve all our customers in the North Sea. ”

Mark Florian, group head of the global energy and power infrastructure funds team at BlackRock, said: “A growing number of institutional investors are seeking exposure to energy and power investments.

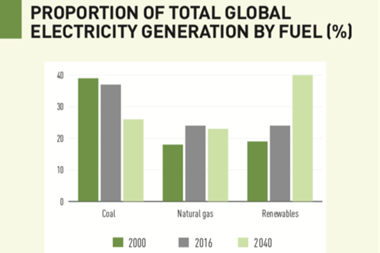

”Within the sector, energy from gas is viewed as a necessary component of the energy transition as we move towards a lower-carbon economy.

Florian said this investment in Kellas Midstream reflects the focus of GEPIF III on making strong equity investments in mid-market energy and power infrastructure and partnering with management teams.

Ang Eng Seng, CIO of infrastructure at GIC, said: ”As a long-term investor, we look forward to partnering with BlackRock and Kellas’ management to support the future growth of the company.”