Top 150 Real Estate Investors 2025

Top 150 Real Estate Investors 2025: Survey

Uncertainty – not least from global tariffs – is holding back a full-blown return to the market. Richard Lowe reports

Access the Top 150 Real Estate Investors data. Support data-driven decision-making.

Gain access to the complete 2025 survey dataset providing detailed information on 150 of the world’s largest real estate investors. Whether you are looking for data on competitors, clients or prospects this data will provide comprehensive insight into opportunities, challenges and market trends in the institutional real assets investment industry.

Top 150 Real Estate Investors 2025: Full ranking

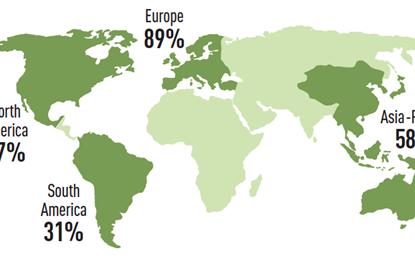

The IPE Real Assets top 150 ranking of some of the world’s largest real estate investors, has captured US$2.04trn (2024: $2.10trn) in property assets held by pension funds, sovereign wealth funds, insurers and other institutional capital owners.

APG’s real estate arm seeks stability in a shifting global landscape

The Netherlands’ largest pension fund is looking to invest more in real estate this year, despite geopolitical uncertainty. Richard Lowe speaks to Rutger van der Lubbe

Ilmarinen looks to real estate debt amid market volatility

Finnish pension insurer Ilmarinen has increased its exposure to real estate debt to tide it over uncertain times, Mikko Antila, head of international real estate, tells Pirkko Juntunen

Home turf prevails over cross-border real estate for Danica Pension

Denmark’s second-biggest pension fund is maintaining a domestic focus for the time being as market recovery generates new opportunities. Pirkko Juntunen speaks to Michael Nielsen

Border to Coast Pensions: Gaining scale for real estate at the right time?

The asset manager of 11 UK local authority pension funds is preparing to expand just in time for a market recovery. Richard Lowe speaks to Alistair Smith

Top 150 Real Estate Investors 2024: Survey

There are signs that investors plan to increase investment activity after a slow 2023. Richard Lowe reports

Top 150 Real Estate Investors 2023: Survey

The long-running trend of rising investment levels finally comes to a close. Richard Lowe reports

Top 150 Real Estate Investors 2022: Survey

Investors show greater caution, as attention switches from COVID-19 to inflation and geopolitics. Richard Lowe reports

Top 100 Real Estate Investors 2021

This year’s real estate survey shows investors holding firm with their pre-pandemic allocations and strategies. Richard Lowe & Rachel Fixsen report

Top 100 Real Estate Investors 2020

Annual survey confirms that a third of investors are putting new investments on hold, and more than half expect the unfolding crisis to affect their real estate strategies and/or allocations

Top 100 Real Estate Investors 2019

IPE Real Assets’ top 100 ranking of some of the world’s largest real estate investors has captured more than $1.34trn (€1.20trn) in real estate assets held by pension funds, sovereign wealth funds and other institutional capital owners.

The Top 100 Real Estate Investors 2018

IPE Real Assets’ top 100 ranking of some of the world’s largest real estate investors has captured more than $1.23trn in real estate assets