All Top 100 Infrastructure Investors articles

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2025: Total assets rise 8% to $926bn

Full ranking of the largest pension, sovereign-wealth and insurance funds in the infrastructure

-

Special Reports

Special ReportsInfrastructure investor survey 2025: Asset class performs and hedges inflation

More than two thirds of investors say infrastructure has provided effective inflation protection

-

Special Reports

Special ReportsInfrastructure investor survey 2025: Investors target digital transition

Data centres and fibre networks lead the pack of favoured sectors

-

Special Reports

Special ReportsInfrastructure investor survey 2025: Investors near allocation targets

Capital flows likely to come from maintaining allocation levels

-

Special Reports

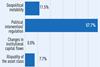

Special ReportsInfrastructure investor survey 2025: Key risks are politics and regulation

Political and regulatory uncertainty the key risks and challenges for investors

-

Special Reports

Special ReportsAustralianSuper: Surfing the AI wave

The AI revolution is top of mind for AustralianSuper and underpins a strategic shift in the investment approach of Australia’s largest superannuation fund

-

Special Reports

Special ReportsBCI: All eyes on ‘transaction-rich’ Europe for growth

Canadian pension fund BCI aims to substantially increase the share of European assets in its infrastructure portfolio, as it continues to look abroad for expansion

-

Special Reports

Special ReportsIndustriens Pension: Co-investment as a pragmatic sweet spot

Industriens Pension has developed a taste for partnering with fund managers on infrastructure investments

-

Special Reports

Special ReportsCPP Investments: Keeping pace with rapid fund growth

CPP Investments has been deploying billions into infrastructure, including data centres, as the pension fund is projected to hit C$1trn by 2031

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2024: Survey

Institutional investors continue their journey in allocating to infrastructure after demonstrating stability during a period of volatility

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2024: Full ranking

The IPE Real Assets top 100 ranking of some of the world’s largest infrastructure investors accounts for more than $858bn (€768bn) in infrastructure assets held by pension funds, sovereign-wealth funds, insurers and other institutional capital owners.

-

Special Reports

Special ReportsAPG plans to expand allocation by investing in ‘tomorrow’s infrastructure’

Jan-Willem Ruisbroek tells Richard Lowe how APG will use its new allocation to build the infrastructure of tomorrow

-

Special Reports

Special ReportsIlmarinen: ‘We’d like to grow the allocation to infrastructure’

Ilmarinen continues to build up global exposure primarily through funds. Pirkko Juntunen speaks to Esko Torsti

-

Special Reports

Special ReportsAPG’s asset owner partnership: Don’t compete, collaborate

The biggest investors are teaming up to tackle infrastructure. Genio van der Schaft talks to Florence Chong about the APG-GPIF partnership

-

Special Reports

Special ReportsPSP Investments: Canadian fund takes own path in global infrastructure

PSP is taking a dynamic and flexible approach as it aims to hit in C$50bn infrastructure assets. Sandiren Curthan talks to Richard Lowe

-

Special Reports

Special ReportsPensionDanmark: Exporting the Danish model in infrastructure

PensionDanmark made a groundbreaking investment in domestic offshore wind 14 years ago. Today, it continues to innovate globally, Rune Gade Holm tells Pirkko Juntunen

-

Special Reports

Special ReportsVelliv: Remain focused on the risks in infrastructure

Christoph Junge tells Pirkko Juntunen how Velliv keeps its fund managers’ feet to the ESG fire to avoid greenwashing

-

Special Reports

Special ReportsPension Protection Fund: From ‘lifeboat fund’ to ocean liner?

The PPF, which could become bigger under UK pensions reform, is expanding and going more direct in infrastructure. Richard Lowe speaks to Alex Leonard

-

Special Reports

Special ReportsGPIF: Japan’s giant signals its intent in infrastructure

The world’s largest pension fund has a lot of room to grow when it comes to investing in infrastructure. Florence Chong reports

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2023: Case studies

We talked to five of the top 100 about their allocations, strategies and the implications of inflation, war and climate change