All Real Assets articles in September/October 2023 (Magazine)

View all stories from this issue.

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2023: Case studies

We talked to five of the top 100 about their allocations, strategies and the implications of inflation, war and climate change

-

Special Reports

Special ReportsTop 100 Infrastructure Investors 2023: Survey

Recent strong growth in allocations and investment appetite might be slowing, but investors are not yet applying the brakes to the asset class. Richard Lowe reports

-

Special Reports

Top 100 Infrastructure Investors 2023: Full ranking

The IPE Real Assets top 100 ranking of some of the world’s largest infrastructure investors accounts for more than $772bn (€719bn) in infrastructure assets held by pension funds, sovereign-wealth funds, insurers and other institutional capital owners

-

Magazine

MagazineIPE Real Assets September/October 2023: A new trajectory

The total infrastructure assets held by the 100 largest institutional investors has doubled from US$360m to US$722bn over the six years that IPE Real Assets has been tracking them.

-

Magazine

MagazineListed infrastructure: A $3trn liquid opportunity set

Is 2023 the year to allocate capital to listed infrastructure? Florence Chong reports

-

Opinion Pieces

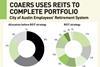

Opinion PiecesGuest view: The untold story about REITs

US REITs are well positioned against harsher market conditions, argue Edward Pierzak and John Worth

-

Special Reports

Special ReportsValesco goes all-in on European offices

Shiraz Jiwa talks to Maha Khan Phillips about clinching France’s biggest office deal of the year

-

Magazine

MagazineMixed picture for APAC REITs

Asia-Pacific’s diverse collection of underlying real estate markets are reflected in the national REIT markets. Florence Chong reports

-

Special Reports

Special ReportsNew York City offices: Sun sets on the Big Apple?

It is probably the spiritual home of the office. But New York is struggling to reimagine itself in an age of technological and urban transformation, writes Vanessa Drucker

-

Special Reports

Special ReportsFrankfurt offices: Wo sind die Arbeiter?

Workers are not returning to Frankfurt offices as much as expected, and the city faces an obsolescence problem. Christopher Walker reports

-

Special Reports

Special ReportsSydney offices: Australian city tries to reignite itself

The recovery of Australia’s largest office sector appears to be at a crossroads. Florence Chong reports

-

Interviews

InterviewsDamien Webb: Aware Super touches down in London

Australian investor sets up shop in UK capital to spearhead an offshore investment expansion. Interview by Florence Chong

-

Interviews

InterviewsJohn Phillips, GIIA: Navigate with ‘sensitivity and awareness’

Jon Phillips tells Christopher Walker why the infrastructure investment industry needs to tread carefully amid rising economic, political and environmental pressures

-

Magazine

MagazineWhy euro-zone REITs look better than the US

Mark Unsworth makes the investment case for European listed real estate

-

Special Reports

Special ReportsLondon offices: Downsizing the Big Smoke

With high-profile occupiers cutting space and commuters showing up three days a week, is London’s office market set for a major reset? Christopher Walker reports

-

Opinion Pieces

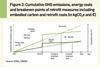

Opinion PiecesGuest view: REITs and the climate challenge

EPRA and CRREM joined forces to help the European listed real estate sector decarbonise, Hassan Sabir and Sven Bienert explain

-

Special Reports

Special ReportsEuropean offices: Move with the changes

As European businesses map out their future office needs, Landlords that can’t provide what tenants require are in danger of obsolescence. Maha Khan Phillips reports

-

Special Reports

Special ReportsUS offices: A tale of three cities

San Francisco and Miami are very different to New York, so is this divergence playing out in their office markets post-COVID? Vanessa Drucker reports

-

Special Reports

Special ReportsValue-add real estate strategies: A green equation

Will the need to decarbonise offices lead to a rush of value-add strategies? Lauren Mills reports

-

Magazine

MagazineA European REIT rebound?

After hitting rock bottom, can European REITs stage a comeback? Florence Chong reports