When I stood on the lawn of the White House last summer to celebrate the signing of the Inflation Reduction Act, I was – and continue to be – struck by the historic nature of what I was witnessing.

It is not an exaggeration to call President Joe Biden’s game-changing collection of policies the most important piece of climate legislation the world has ever seen.

An investment package of $369bn (€341bn) is to be targeted towards energy security and climate change initiatives, with two-thirds to be used to extend or introduce tax credits for emission-free electricity generation and storage technologies.

For those of us who have been working with these technologies since the early days, the vast ambition baked into the act is recognition of the hard yards we’ve made in developing the means to tackle the climate crisis.

As the investment manager of Gore Street Energy Storage Fund (GSF) – London’s internationally diversified listed fund dedicated to supporting greater integration of renewable electricity through energy storage – Gore Street Capital had already been looking at the US for some time.

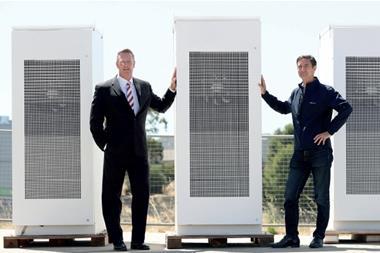

We announced the fund’s US entry in March 2022 with the acquisition of a portfolio of operational and under-construction assets in Texas. GSF has since secured two more US projects in Texas and California, both of which will benefit from investment tax credits worth up to 30% of qualifying capital expenditure offered by the Inflation Reduction Act.

This measure will help offset some of the rising costs we’ve witnessed in energy storage, stemming from supply chain constraints and the availability of raw materials, and help ensure our projects are delivered on schedule in 2024.

Thanks to this practical financial assistance, and the certainty offered by ten years of investment in renewable energy solutions, our eyes are firmly fixed on the US as a climate leader. The drive to reduce emissions – potentially by 40%, below 2005 levels, by 2030 – and lower household energy bills through investment in a clean future is a strategy that should be adopted around the world, not just in the US.

And yet the EU and UK have both looked across the Atlantic with concern as they try to deal with the fallout for European companies. Biden’s legislation certainly prioritises American interests through more tax credits for domestically sourced and produced content, which could discriminate against European technology providers unless they move operations to the US.

A war of words has followed, with threats of retaliation and appeals to the World Trade Organisation suggested. The irony of European protests to clean energy advancement following years of complaints that not enough progress is being made by the US is not lost on me.

What has followed, however, are the kind of green policy recommendations that should have been adopted years ago.

The Green Deal Industrial Plan for the Net-Zero Age aims to loosen the purse strings around state aid for clean tech manufacturing; reforms to the EU’s electricity market design will see renewables and energy storage placed front and centre; and a green skills programme will ensure no one is left behind.

All of this still needs to be debated in the European Parliament, with smaller countries likely hoping to ensure France and Germany do not continue to receive the lion’s share of state aid as they have done since March 2022.

But as the CEO of an investment manager with responsibility for renewable energy storage solutions in Ireland and Germany – with more EU countries being investigated – I am buoyed by the language being adopted by the European Commission. There is now a solid understanding that energy storage will underpin a decarbonised and secure EU energy system by providing the necessary flexibility, stability, and reliability of the whole energy system.

It could be argued these measures were inevitable following Russia’s illegal and abhorrent invasion of Ukraine, which turned Europe’s energy market on its head and prompted a rapid shift away from fossil fuels. But I would argue the Inflation Reduction Act accelerated this action even further and places both the US and EU on a greener path at a time when rapid climate action is a necessary imperative.

The latest IPCC report delivered a final warning to the world: the window of opportunity to secure a liveable and sustainable future is almost closed.

Now it is for the rest of the world to respond. At the time of writing, the UK has been conspicuous in its absence from responding to the actions of its US and European partners. It could be that the country’s failure to establish its own green manufacturing base has removed the same urgency felt by EU policymakers, but continuing to falter will widen the gap further.

We will continue to track all opportunities to deploy energy storage technology and support the rapidly hastening low-carbon transition, and it is through positive economic conditions like those brought about by the Inflation Reduction Act that this activity can thrive.