UK open-ended property funds have been criticised in the mainstream press for gating their investors for long periods of time. The cash levels in these funds have risen steadily as assets have been sold and two long-suspended funds have recently announced they will re-open before the end of Q2 2021.

Looking ahead, the indirect investment team at DTZ Investors wondered if investors in UK property funds would benefit from an allocation to real estate equities, which are inherently more liquid than bricks and mortar. The analysis undertaken suggests that by allocating up to 10% of assets to UK real estate equities, UK open-ended property funds would have greater liquidity, investor returns could potentially be higher and there could be other potential benefits derived from enhanced diversification and flexibility. Moreover, a low portfolio weighting to real estate equities, allied with prudent stock selection, would minimise any negative impacts associated with equity market volatility.

Drawing on quarterly data from the past 20 years, it is evident that real estate equities offer direct real estate investors a range of potential benefits, as outlined below.

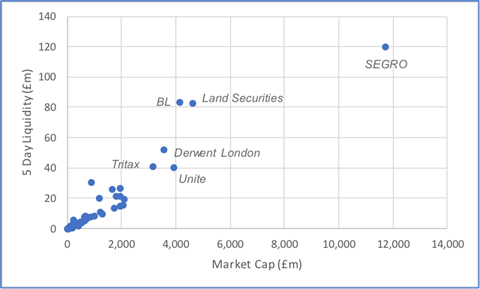

Liquidity: real estate equities can provide immediate market access, and liquidity can be achieved quickly when needed. Investments in the largest listed real estate companies are the most liquid, but it should be possible to trade in or out of £5m (€5.8m) or £10m within five business days in almost all companies with a market capitalisation of more than £400m.

Diversification: the trade-off for holding a real estate investment in this more liquid form is greater volatility. At the aggregate level, it is true that real estate equities are more closely correlated with the wider UK equities market, but over the 18 months to the end January 2021 almost a quarter of listed real estate companies exhibited share price changes that had weak positive correlation or even negative correlation with movements in the FTSE All Share index. Many of these companies are operating in ‘alternative’ real estate segments, such as primary healthcare, self-storage, residential and social housing, which have different drivers from the more mainstream segments of office, retail and industrial. So it is possible to reduce equity market risk at the same time as diversifying portfolio returns, by getting liquid exposure to these specialist segments of the UK real estate market.

Performance: an allocation to real estate equities of up to 10% holds out the prospect of better performance than a purely direct real estate portfolio and, moreover, this only has a modest impact on volatility. Real estate equities outperformed direct real estate (as measured by the MSCI Quarterly index) in 11 of the past 20 years and figure 2 shows that, on average, real estate equities also delivered a higher annual return. While this higher return came at the expense of greater volatility, the table also shows that a portfolio combining 90% direct real estate and 10% real estate equities would have recorded only a marginal increase in volatility; and the average return would have been higher than a portfolio comprising 100% direct real estate.

Flexibility: real estate equities can be used to gain access to a preferred segment of the market that, for a range of reasons, might be more challenging to acquire directly. For example, primary healthcare is a specialist segment and typical lot sizes are less than £4m, so it makes sense to gain exposure via one of the listed REITs – Assura or Primary Healthcare Properties.

Cost: the round-trip costs of buying and selling real estate equities are significantly lower than direct real estate.

UK open-ended property funds often have the scope to invest in real estate equities, but the proportion held is typically small. Looking ahead, a larger holding in UK real estate equities might provide investors with the liquidity they want, and their hold period returns might potentially be higher, but they might have to accept marginally increased volatility. On balance, this could be an acceptable trade-off for investors in these funds.