Banks are retrenching from the market, so alternative lenders could fill the gap. Lauren Mills and Richard Lowe report

In October, Bayes Business School published its most up-to-date report on the state of the commercial real estate lending market in the UK. It came a month after a government tax-and-spending announcement that led to turmoil in the UK’s bond markets and most likely exacerbated rising interest rates and costs of debt in the country.

The Bayes report is probably the most authoritative study of the market, and with today’s uncertainty investors and lenders want as much information and insight as possible. But as is so often the case with private markets, the report can only look in the rear-view mirror, showing a strong first six months of activity for 2022, with £23.7bn (€27.5bn) of new lending.

However, looking forward, Nicole Lux, senior research fellow at Bayes and author of the bi-annual report says debt affordability is “already in sharp decline”.

In the UK, the five-year Sonia [Sterling Overnight Index Average] swap rate, the base on which most commercial debt is written, has quadrupled in the past 12 months to 5%.

Lux says: “Public debt markets have already reacted to increasing interest rates with a sharp drop of new bond issuance, while private debt residential and commercial mortgage providers have been busy running stress tests to consider any additional capital required to cover risks on their lending books.”

In response, lenders are moderating the loan-to-value (LTV) ratios they are prepared to accept. This is a sensible, if unwelcome move, because it ensures there is sufficient capital available to service the debt.

As Andrew Radkiewicz, global head of private debt strategy and investor solutions at PGIM Real Estate, which at the beginning of the year raised €1.8bn for European debt fund, says: “What we have at the moment affecting debt markets is higher interest rates and higher bid-ask spreads. Then there are banking and lender spreads on top, exacerbating the issue, with lower loan-to-value and low leverage being available. This combination is taking a lot of potential lending out of the market.”

Peter Cosmetatos, CEO of real estate lender association CREFC Europe, reckons LTVs will drop from around 60% to 50%, as debt financing deals are inevitably restructured to reduce risk. “Suddenly, borrowers are finding that the cost of a new loan is only going to be available at an LTV of 50%. This means the cost of your quarterly payments is going to be twice what it was because of rising interest rates. Lenders need to ensure they are getting good relative value.”

There is consensus among developers, investors and lenders that the changing financial and geopolitical environment is creating a ticking time bomb for hundreds of loans that are maturing in the next 12 to 24 months.

A lot has changed since the beginning of the pandemic when many lenders were very accommodating to real estate borrowers because they wanted to keep the market alive amid the COVID chaos.

Neil Odom-Haslett, head of commercial real estate lending at Abrdn, says: “That was nearly three years ago, at a time when lenders essentially kicked the can down the road and would extend loan terms by one or two years because of what was going on.

“A lot of those loans are coming up for renewals, and the world is now a very different place. Lenders have generally been more disciplined this time around. So I don’t necessarily see the distress on the senior debt side. But on the mezzanine side, that’s a different story. I think you will see distress in that market.”

Odom-Haslett believes there will be tens of billions of pounds of new financing a year in the UK and Europe in the next one to three years, of which up to 40% will be provided by alternative lenders.

“Suddenly, borrowers are finding that the cost of a new loan is only going to be available at an LTV of 50%. The cost of your quarterly payments is going to be twice what it was”

Peter Cosmetatos

But for the refinancings to be approved, a major shift in bid-ask spreads is needed as the market endures one of the most painful price corrections for decades.

Odom-Haslett says he has seen valuations reduce by around 20% in some sectors. But many more downward valuations are yet to come.

He adds: “While there’s been a reduction, valuers haven’t pushed the ‘material change’ clause into their valuations yet across the board. They’re increasing the yields and reducing values across the board for all asset classes, though, and some a bit more than others.”

Lux agrees. She estimates that real estate net income yields need to rise to more than 6%, or property values need to adjust downwards by between 25% and 35%, to reach a new market balance.

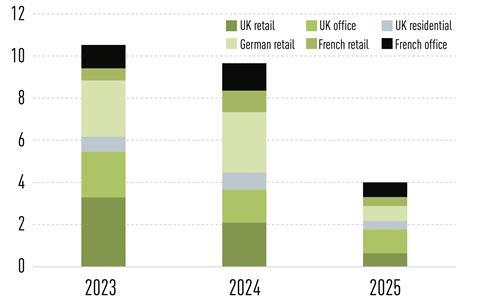

In research published in November, AEW has estimated the size of the debt funding gap in Europe for the next three years at €24.2bn. Crucially, over half of this is made up by the UK’s expected shortfall, at €12.8bn, followed by Germany at €6.2bn (see figure).

The Bayes report also showed that the proportion of UK lending market take-up by alternative lenders – including insurance companies and debt funds, often backed by pension funds – has experienced 12 years of continuous growth, rising on average 15% per year.

The question now is, with traditional lenders expected to withdraw from the market, will an ever-bigger opportunity open up for the debt funds?

Lux says that, with the UK entering a dramatically different interest-rate environment, mainstream lenders such as banks and building societies will likely pass on funding opportunities to alternative lenders that can provide mezzanine finance.

ESTIMATED DEBT FUNDING GAP ACROSS SELECTED MARKETS (€BN)

Peter Hansell, senior director of debt strategies for Nuveen Real Estate Europe, believes that opportunities for the debt funds and alternative lenders are increasing, as the traditional lender takes more of a risk-off stance. “Financing has to be structured in a very different way in a high-interest-rate environment,” he says. “This presents an opportunity for the debt funds and the alternative lenders. They have a different pricing model typically and are driven by slightly different views on what is acceptable risk.”

But it is far from a straightforward opportunity and not one without risks. “The question that we have to try to answer is what is the valuation risk that sits in the numbers? What is the risk in terms of the loan-to-value or future loan breaches, because maybe the sentiment hasn’t been factored in enough at this point. So this is when we need to spend more time, at this point in the cycle, on the due diligence process,” Hansell says.

Odom-Haslett says the opportunity will require discipline and track record. “It is about backing an experienced manager that has been there, done it and seen it before, with a good team with experience through a global financial crisis. Or you need a manager who can understand the markets, knowing when to pull back.

“You also need to work with borrowers and understand how they have reacted during previous peak and trough cycles and what their behaviours have been. You need to ensure you back the right borrowers.”

“Public debt markets have reacted to increasing interest rates with a sharp drop of new bond issuance while private debt residential… have been busy running stress tests”

Nicole Lux

Savills Investment Management, which runs real estate debt funds through its DRC arm, is keen to take advantage of the situation. But as chief executive Alex Jeffrey says, it is likely to be one that requires patience. “We are waiting it out for a period,” he says. “We don’t see any particularly compelling reason to make new loans at the moment, even though we’ve got quite a lot of dry powder.”

This is because, he says, an equilibrium has not yet been reached in property values. “It’s really difficult to assess what your true LTV is and therefore what your risk profile is [in] any lending decision,” he says.

“But we also feel that the markets are coming towards us in that other lenders are pulling back. There’s a huge refinancing requirement coming and therefore we think that the supply-demand imbalance will become ever greater between borrowers and lenders, and therefore you’re better off waiting for a little while until the market clears.”

And the current challenges in the market do not only revolve around repricing and cost of capital. Lenders have to navigate a range of issues, more structural issues, unrelated to the market cycle, ESG and net zero being clear examples.

Cosmetatos urges lenders and investors to consider how their investments in the coming months are going to help fund decarbonisation.

“If I’m a lender, would I rather be lending against the shiniest, greenest most sustainable building in London today, knowing that in three or four years’ time, when my loan matures, it will no longer be the shiniest, greenest most sustainable asset in London? Investors need to consider, how easy, or not, it will be to refinance their asset and their loan at that point.”

An alternative approach, according to Cosmetatos, would be for debt providers to fund “middling assets where you’ve got sponsors with a good strategy and you’re providing some of the capital to improve them”.

He explains: “Then, in three or four years’ time I know the asset that I need to have refinanced is going to be better relative to the market at that time, and relative to itself. Pursuing a strategy that drives the green transition makes sense and should tick ESG boxes. And I know that I have, at the end of my loan, a better asset than I had at the beginning.”