The UK led a slowdown in commercial real estate investment across Europe in the first half of 2016, as the uncertain outcome of the country’s referendum on its EU membership added to a catalogue of risks deterring investors.

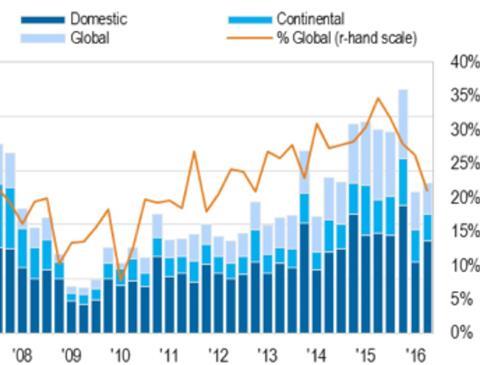

According to research by Real Capital Analytics (RCA), the total value of commercial property transactions completed in Europe during the first six months fell by 35% from the same period in 2015 to €107 bn.

The UK registered a 45% decline from a year earlier to €29.5 bn, as investor concerns in the run-up to the 'Brexit' vote and high pricing played a part in slowing investor activity. The UK accounted for more than half of the total drop in investment in European commercial properties during the period.

After the UK, Europe’s second biggest market, Germany, suffered the most in terms of falling investment volumes, which dropped by 36% versus the first half of 2015. Of the top 10 markets, France was next in terms of falling volumes, as investment decreased by 29% over the same period.

'A number of global economic, financial and social risks have made investors more cautious about where to deploy their capital allocation to European real estate after a record-breaking year in 2015,' said Tom Leahy, RCA’s director of EMEA Analytics. 'The build-up to the Brexit vote added to these concerns and was a notable brake on investment in the UK. While it’s no surprise that Central London was particularly affected, our data indicate that the investment cycle had probably already peaked in the third quarter of 2015 and before the vote was announced.'

The value of transactions in London, which ranks second to New York in the world’s top investment destinations, fell by 52% to €14 bn in the first half. Pricing in the Central London office market, as measured by the RCA/PD Commercial Property Price Indices (CPPI), remained little changed on the quarter for the first time since 2012.